Unaffordable Utah: Couple considered divorce to get daughter expensive surgery

Mar 14, 2018, 12:10 AM | Updated: Jul 12, 2018, 5:33 pm

John and Jennifer Meredith considered getting a divorce so that their daughter could qualify for Medicaid coverage.

SALT LAKE CITY – A happily married Utah couple considered divorcing in order to get their daughter a $100,000 surgery their insurance wouldn’t cover.

“We had no desire to get divorced,” said Kaysville resident John Meredith about the plan to end his marriage with his wife, Jennifer.

“You file the papers,” Jennifer Meredith explained. “He moves out and then we go and say, ‘Look, we don’t have a two-income household anymore.’”

They hatched the idea after fighting with insurance companies for more than four years to get their daughter Maren, 9, a cochlear implant. By splitting up, Jennifer could apply for Medicaid, which would cover the procedure.

“We couldn’t keep putting that off,” John said about Maren’s surgery. “She’s completely deaf in her right ear and she’s mostly deaf in her left ear.”

The Merediths aren’t alone in their struggle to afford medical care. The most recent Stress in America report from the American Psychological Association found that 66 percent of Americans list the cost of health insurance as a stressor.

“We hear a lot of different complaints,” said Stacy Stanford, an analyst with the Utah Health Policy Project. “The out-of-pocket squeeze is what hurts people.”

As the clock ticked on Maren’s chances of having a successful outcome with the implanted hearing device, John and Jennifer gave up on negotiating with the insurance company, but couldn’t find a way to pay for the expensive surgery themselves.

“What middle class family can come up with $100,000 for a medical procedure?” John said. “It’s crazy.”

The price tag seemed especially insurmountable given the family’s already high out-of-pocket costs for health care—even with insurance from John’s architectural firm.

After waiting four years, Maren received the cochlear implant after her father lost his job and the family qualified for Medicaid.

“Health care is more than our cars, more than our car insurance, more than our house, all put together,” John said.

Last year alone, the family of five spent $25,000 for insurance premiums and another $20,000 to cover their deductible, co-pays and co-insurance.

“We don’t eat out, we don’t go to movies,” Jennifer said. “We don’t celebrate birthdays or any of that stuff.”

In December, the Merediths got more bad news: John lost his job. But it turned out to be a blessing in disguise, because without a paycheck they could finally get approved for Medicaid.

John Meredith removes the bandage from his daughter’s ear the day after her cochlear implant surgery.

Fast forward a few months, and Medicaid approved and paid for the cochlear implant surgery.

“It’s been four years that we’ve been fighting for this,” Jennifer said as Maren recovered at home in early March.

From selecting your plan to forecasting how much you’ll pay, none of it, she explained, is designed for transparency.

“The system is not set up to empower people who are sick or have health issues,” Stanford said.

As frustrations have grown, so too have the number of Americans on high-deductible insurance plans, defined by the Centers for Disease Control and Prevention (CDC) as policies requiring annual deductibles of $1,300 for an individual or $2,600 for a family.

“We know that about 70 million people in the U.S. have high-deductible health plans,” said Angela Fagerlin, Ph.D., Chair of the University of Utah Health’s Department of Population Health Sciences.

The percentage of adults on such plans jumped from 26 percent in 2011, to nearly 40 percent in 2016, according to the CDC. Even so, a recent study discovered consumers are not adapting to the new marketplace.

“I think it’s uncomfortable,” said Fagerlin. “Nobody wants to admit that they can’t afford it or that money would be an issue.”

The study, published by a team from the University of Utah Health and the University of Michigan, found that only six percent of those with high out-of-pocket costs try to negotiate prices.

“It doesn’t matter what kind of person you are, it’s hard for everybody,” said Fagerlin, chairwoman of the department of population health sciences at University of Utah Health and a senior author of the paper.

She advocates for better cost-comparison information being made available to patients, so that they have the necessary tools to shop around for services.

Experts suggest those with high out-of-pocket health care costs talk with their doctors about ways to save money.

“I think that’s where we need to start,” Fagerlin said, “because we can’t ask people to be consumers if we don’t give them information to do so.”

Even so, she encourages patients to talk with their doctors about options. While they might not know the answer to financial questions right away, they could help find the right person.

“I think it’s really important for people to say, ‘Hey, I’m in a high-deductible health plan and I haven’t met my deductible, so a lot of this is coming out of my pocket,’” Fagerlin said.

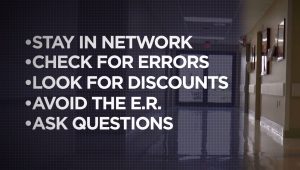

Also, experts suggest other strategies that Utah families can take right now to save money, including:

-Staying in network for all health care encounters, including labs and x-rays.

-Checking every doctor bill and insurance explanation for errors.

-Looking for discounts on pricey prescription drugs.

-Avoiding costly urgent care by going to a doctor’s office with extended hours or trying a video consultation first.

-Keeping a detailed medical record to avoid paying twice for the same test.

-Asking questions before undergoing expensive procedures.

While those tips would not have helped the Merediths get a $100,000 surgery, the family hopes for broader changes to the system and more compassion for those struggling to afford care.

“It’s not about you and how you’re doing fine,” Jennifer said. “It’s about all of us and if we’re doing fine—and we’re not.”