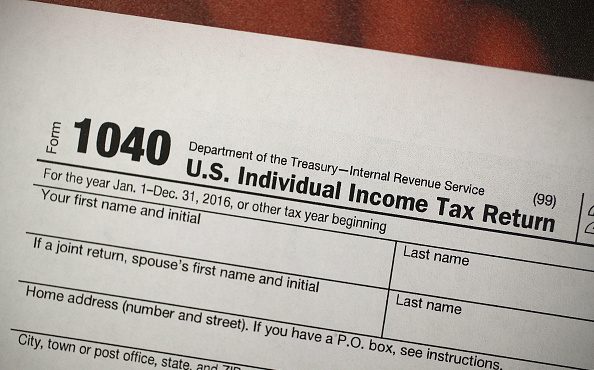

IRS Won’t Issue Tax Returns If Government Shutdown Continues

Jan 4, 2019, 10:51 AM

Photo by Joe Raedle/Getty Images

SALT LAKE CITY, Utah – Those who considered filing their taxes early in hopes of a quick refund this year might find their efforts futile.

According to the Internal Revenue Service’s Lapsed Appropriations Contingency Plan, just fewer than 13% of employees will be working during a government shutdown.

Those essential duties that remain in place do not include performing audits, paying refunds or offering assistance to tax payers, according to CNN.

However, the IRS still wants your money if you owe taxes. While it won’t process refunds, it will still take payments.

The Wall Street Journal on Wednesday reported that the IRS will still process tax returns that include payments as well as keep computer systems running and continue criminal investigations.

RELATED: Ogden IRS Workers Live In Uncertainty As Shutdown Continues

Magnifying the issue, there isn’t any help provided to those seeking assistance filing this year, outside automated services, that is. This comes during the year when the tax code has been changed, so there may be changes to the filing process that people aren’t familiar with.

According to CNN’s report, those who call the IRS with questions get an automated message that says: “Welcome to the IRS. Live telephone assistance is not available at this time. Normal operations will resume as soon as possible.”