Three Big Ways Small Business Would Benefit From The New COVID Relief Package

Dec 28, 2020, 7:03 PM | Updated: 7:58 pm

(CNN) — Given how much the pandemic has hammered small businesses, three big changes to the Paycheck Protection Program are likely to come as a welcome relief.

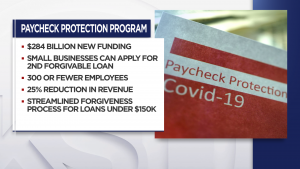

The new COVID relief package signed into law on Sunday night allocates an additional $284.45 billion in lending to eligible businesses.

The PPP-related measures in the package now make it possible for a business owner to get a second forgivable PPP loan and imposes fewer restrictions on how the loan may be used. It also relaxes requirements to have small loans forgiven. And it lets businesses deduct the expenses that their PPP loans paid for.

“Everybody’s excited about the new round #PPP because it’s going to help a lot of businesses"@UtahBankers tells @KSL5TV about improvements to the Paycheck Protection Program

“We’ve got billions of dollars out there that are waiting to be forgiven”

FULL STORY next at 6:30 pic.twitter.com/BG2cWN8qta

— Ladd Egan (@laddegan) December 29, 2020

Plus, this time, there are special provisions designed specifically to help restaurants and minority-owned businesses.

Chris Hurn, founder of Fountainhead, a nonbank lender that makes Small Business Administration-backed loans, described the measures as a Christmas gift for small businesses.

Here are some of the key changes that will be made to the PPP loan program:

Businesses May Now Take A Second PPP Loan

Businesses that got a PPP loan when the program first went into effect now may apply for a “second draw,” so long as they’re not a public company, don’t employ more than 300 people, have used or will fully use their first PPP loan, and can show at least a 25% drop in gross receipts in the first, second or third quarters of this year compared to the same quarter in 2019.

Specific amounts are earmarked for community development financial institutions — which typically lend to minority-owned businesses in underserved communities — and also for businesses with fewer than 10 employees, as well as those in low-income areas.

(KSL-TV)

Most eligible businesses may get a loan equal to 2.5 times average monthly payroll expenses, just as before. But restaurants and lodging businesses may now apply for loans equal to 3.5 times.

No loan may exceed $2 million, down from $10 million originally.

Streamlined Forgiveness Process For Loans Under $150K

In order to have a PPP loan forgiven, businesses that borrowed $150,000 or less will simply need to submit a one-page certification that includes the number of employees the business retained as a result of the loan, an estimate of how much of the loan was spent on payroll and the total loan amount. Borrowers must also attest that the information is accurate and that they complied with loan requirements.

For any PPP loan to be fully forgiven, at least 60% of the money must be used for payroll expenses. And the remaining 40% or less may be used to cover an even broader swath of business expenses than was the case during the initial rounds of PPP lending.

Beyond mortgage interest, rent and utility payments, the loans, for instance, now may be used to cover the costs of personal protective equipment and other expenses incurred to meet COVID restrictions, as well as certain operations, property damage and supplier costs.

Huge Tax Break On Business Expenses

Businesses normally deduct their payroll and operating expenses from their gross income.

But for businesses that get PPP loans, those expenses are largely paid for by the loan.

The latest COVID relief package clarifies that if the loan is forgiven, it will be treated as tax-free to the business.

And it further clarifies that even though the tax-free loan may have paid for many payroll and operating expenses, a business may still deduct those expenses on their tax return.

Tax policy experts frown on lawmakers’ decision here because it’s considered a “classic double dip” into the taxpayer’s pocket.

“Businesses that got PPP grants want to deduct those costs as ordinary business expenses. But taxpayers already paid for those expenses once through the PPP program. Why should they pay for them again? Well, because business lobbyists are very good at what they do,” Tax Policy Center senior fellow Howard Gleckman wrote in the blog TaxVox.

But for small businesses that have just been trying to stay alive during the pandemic, it’s a huge source of relief because their revenue has been so hard hit and any real recovery for them may be long in coming as COVID restrictions and consumer fear linger.

The CNN Wire

™ & © 2020 Cable News Network, Inc., a WarnerMedia Company. All rights reserved.