KSL+: Breaking Down Proposed Families Plan

May 6, 2021, 7:00 PM | Updated: Jun 3, 2021, 4:00 pm

SALT LAKE CITY, Utah – President Joe Biden’s has touted the proposed American Families Plan as an investment in our children, our families, and our economic future. Like the American Rescue Plan, which passed in March, and the American Jobs Proposal, currently on the table, the Families Plan has a huge price tag.

What does it all mean? Here are some of the main points of that plan from the White House. The plan would add at least four years of free education. That’s two years of free preschool and two years free community college. It will provide direct support to children and families. That’s direct support to low and middle income families to ensure that they don’t spend more than 7% of their income on childcare. And will provide comprehensive paid family and medical leave that would bring the US in line with every other developed, and many underdeveloped nations in the world. It will extend tax cuts for families with children and American workers. This would extend tax cuts to low and middle income families through Child Tax Credit, the Earned Income Tax Credit, and the Child and Dependent Care Tax Credit, and extend the expanded health insurance tax credits already in place through the American Rescue Plan.

As you might expect, this is getting a lot of mixed reaction from lawmakers. But we wanted to get kind of Behind the Headlines take a closer look a deeper look at where Utah families are struggling, and what impact the President’s proposal might have on that. So to help out to answer those questions.

Matthew Weinstein is the fiscal policy director at the child advocacy group Voices for Utah Children.

Editor’s note: interviews have been lightly edited for clarity and readability.

Matthew Weinstein: So the main way that we measure this is by looking at the poverty rates. And you know, it’s an area where we do better than most states, actually than just about any state. And that’s what this chart shows that in the last year for which we have data, in 2019, the national poverty rate for children was almost 17%. Here in Utah, it was only 10%. Now, when you say only 10%, though, you have to keep in mind, you’re talking about almost 100,000 children living below the poverty line. We had about 930,000 kids in Utah in 2019, the highest percentage of children of any state in the country. 29% of our population is under 18. And so a 10% poverty rate is still pretty substantial. That’s a lot of kids who are at risk of not graduating high school, not getting the education that they need, maybe even getting into trouble with the law. The risks are a lot higher once you get below the poverty level. And we see that we actually have a lot of disparities between majority and minority groups in Utah when it comes to poverty. SO this chart shows Utah in green and the US in blue. You can see the white poverty rate for Utah is 7%. But Hispanic is 16%, and then going looking at children, 6% poverty rate for white children, which is still pretty substantial, but all the way up at 22% for Hispanic children. That’s about one out of every six children in Utah, which means 1/6 of our future workforce. So that’s a real concern when we have those sorts of gaps. And it’s really in our interest to do everything we can to close those gaps. You know, we don’t want to find ourselves 10, 20, 30 years from now, where some of the other states like, California and Texas that have these huge, seemingly insurmountable majority-minority gaps. We’re at a point where we could potentially help close those gaps now. And so that’s one of the reasons we’re so excited about the legislation that was passed at the federal level for the COVID relief as well as this new proposed legislation from the Biden administration.

Matt Rascon: Maybe you can get into then where you feel like this could help fill the gap.

Matthew Weinstein: Okay. So the biggest thing that the Biden administration has done for children under what was passed last month, with the American Rescue Plan is the child tax credit expansion. The Child Tax Credit expansion is the biggest piece of that. And it’s expected to cut the child poverty rate this year, about in half, which is tremendous. It’s really the biggest thing the federal government has done about child poverty. And as long as anyone can remember. So that’s big. And the proposal that he’s calling the American Families Plan would extend that expansion of the child tax credit. And some of the details of that people would be getting a monthly direct deposit, instead of having to wait for tax time. And it would be $250 a month for older kids—6-17. $300 a month per child for the younger kids ages zero to five. And you know, that’s a big improvement over the current child tax credit. And the current child tax credit, already is an improvement. Thanks to Senator Lee, our own Senator Mike Lee fought to make it better back in 2017. And make it larger, make it also more available to lower income families by having a bigger refundable portion of it. You know, the refundable portion is what you get if you don’t actually have any income tax liability. As you know, a lot of lower income families pay a lot in taxes. They pay payroll taxes, they pay state, and local sales and property gas taxes, but they may not owe income tax. But this allows them to get a refund to offset some of those other taxes that they pay. But the way that it was set up until this year, was that the child tax credit refundable part phased in to the point where you didn’t get the full amount until you were making at least $12,000. And you know, for most of us, $12,000. That’s not a lot of money. But you know, if you’re a single mom who’s working part time, at a minimum wage job, you may well be under that threshold and not getting the full amount per child. Now you will, under this expansion under the American rescue plan, it’s now available on that monthly basis to everyone. And it’s actually very similar to the proposal that Senator romney put on the table. Our own senator romney came up with a terrific proposal called the Family Security Act, that actually in some ways was even more generous than what the Biden administration ultimately went with, to expand that child tax credit, make it available to all families, including the lowest income families. So that’s really the biggest part of the proposed American Family plan is to make that expansion of the child tax credit permanent. So and that would cost about $100 billion a year. It’s got a hefty price tag. But, you know, that’s taxes that people are paying now that they wouldn’t be paying. And so the Biden administration is proposing tax increases on, you know, upper income Americans to make up that lost revenue.

Matt Rascon: Under the American families plan, education seemed to be a really big part of the plan also.

Matthew Weinstein: So the education piece of the Biden proposal is very important for closing these majority-minority gaps. You can see that right now Utah, has majority minority gaps for high school graduation rates are actually larger than nationally. So if you’re white in Utah, your high school graduation rate is about the same as whites nationally. But if you’re Hispanic in Utah, you’re actually three points behind Hispanics nationally, that means that the gap is 11 points, here in Utah, between white and Latino versus only eight points nationally. So we actually are a little bit behind the eight ball on that one, you really need to be closing. And so that’s where some of these investments proposed, and the American families planning really helped with that. So for example, they’re proposing making pre-k available for three- and four-year olds on a universal basis, just like we do with kindergarten and K through 12 education. And that is smart, because you got to start early, especially with the kids who are most at risk of arriving in first grade not ready to learn the way the other kids may be. And that is something you can address with a high quality pre-k program. And we’ve actually started doing that here in Utah. We’ve got the Pay for Success model that the legislature agreed to begin funding back in 2014. That’s the model where it was actually Goldman Sachs, that puts up the upfront money and only gets paid back by the state. If we save money, we the taxpayers save money in the long run, because those kids who are getting the pre-k, then don’t need special education services years later, because they’re getting that early intervention that saves money in the long run, that gets those kids on track from the beginning. So they’re not falling behind. And they don’t need special education later. And we’ve been expanding that here in Utah, that’s terrific. The Biden proposal would put 10s of billions of dollars a year into that nationally, which really makes a lot of sense for the parents that want that option for their kids.

It would also expand funding at the college level. Right now, we sort of think in terms of education as being a K through 12 commitment. This would make it more like pre-K to 14, which is really more in tune with what our economy needs right now as well. You may recall that under our last governor, here in Utah, we set a goal of 66 by 2020. That was the mantra, actually back in I guess it was probably 2014. When Governor Herbert was running for reelection, he said he wanted 66% of Utahns to have a post-secondary certificate or degree by 2020. Well, we didn’t make that goal. We didn’t even come close, unfortunately. And the reason is simply, it’s expensive. You know, these kinds of upfront investments in education cost a lot of money. And it’s hard for states to make that investment on their own without federal help, because, you know, we’re competing with Colorado and Arizona and Nevada, for companies that may move here or companies here that are figuring out where to expand. And so that’s why states are under pressure to keep their taxes low, and not necessarily make these big, heavy, expensive investments. So that’s where the federal help will make a lot of sense, to make it possible for more of our kids to go to college, without having to worry about going into debt, without having to worry about not being able to afford it.

Matt Rascon: The American families plan would cost an estimated $1.8 trillion dollars, President Biden has proposed a tax hike on the top 1% of American earners, and has said that no one making less than 400,000 a year would pay more in taxes. Where are those dollar amounts going to come from? And what’s going to be the impact to the economy of where those dollars come from?

Here’s Phil Dean. He is an economist and public finance senior research fellow at the Kem C. Gardner Research Institute at the University of Utah.

Phil Dean: I think you need to look at it in the broad context. So we had a federal government that already had a budget deficit prior to the pandemic. And then we’ve had the pandemic bills that have increased the deficit. There’s a proposed infrastructure bill. That’s also very large, and then this bill that’s very large. So I think it’s important to look at all of those in context and seeing the picture comprehensively in terms of what is the impact to the deficit, how much of this is going to be financed and essentially repaid in the future somehow? And kind of what are the benefits and costs? I’m an economist. So that’s kind of my starting point is I’m comparing benefits and costs. And there are benefits to this. And there are costs to this.

Matt Rascon: Does one outweigh the other?

Phil Dean: So that’s the political decision that the policymakers get to make. There are always these debates about economic efficiency and equity. And I do think I see pieces in there that that I think policy makers need to think really seriously about in terms of economic efficiency, and are the ways that we’re going to pay for these bills. Are those going to create a drag on the economy in the short term and in the long term? And how are those going to be offset by the benefits that come along with that? So I certainly think we need to be careful when we’re thinking about some very significant dollar amounts that we’re seeing in these bills.

Matt Rascon: What’s your take on how the White House has proposed paying for not just this bill, but even like the infrastructure plan, you know, that that jobs plan that he has, you know, just the idea of taxing those, you know, making 400,000 Plus, and what does that actually look like? And does that actually work?

Phil Dean: I haven’t seen specific numbers. So I can’t speak to specifically the impacts. I do think it’s an important conversation that we need to have here. In our country, in terms of how do we pay for the things that government does? And I know there’s always discussion about a fair share. But what is the fair share? And as you look at not only the cost of government, but the benefits of government, kind of how are those distributed? I also, you know, think a lot about how those, so you look at high income individuals, how did they earn that income? Was it kind of what I would consider from true improvements to the economy? Or were some of those profits earned by kind of tilting the playing field in their favor to earn those profits? And I might think differently about taxing one compared to the other? Yeah, so for me, it’s understanding better the details of how we pay for it. But another important pieces, as I read through it, certainly, in today’s time, I haven’t been able to understand all the all the pieces of it. But just thinking about the role of federal government in education. So the federal government does currently in the higher education system, do a lot in terms of Pell Grants, does a lot in terms of student loan guarantees. So they’re definitely in the higher education business. But I think it’s one of the questions is, as it you know, talks about community colleges, what are the strings attached? When the federal government’s paying for something? And that’s those are some questions, I think we need to understand better, how much of the higher education policy is going to be dictated by the federal government along with those federal dollars that would come? versus how much are we going to control here? And similar, you know, with funding for the K-12 system or for preschool that was emphasized, just fully understanding, what are the strings that come with all those federal dollars?

Matt Rascon: In your mind, I mean, is this 1.8 trillion plan? Is this worth the benefits that potentially come out of something like this?

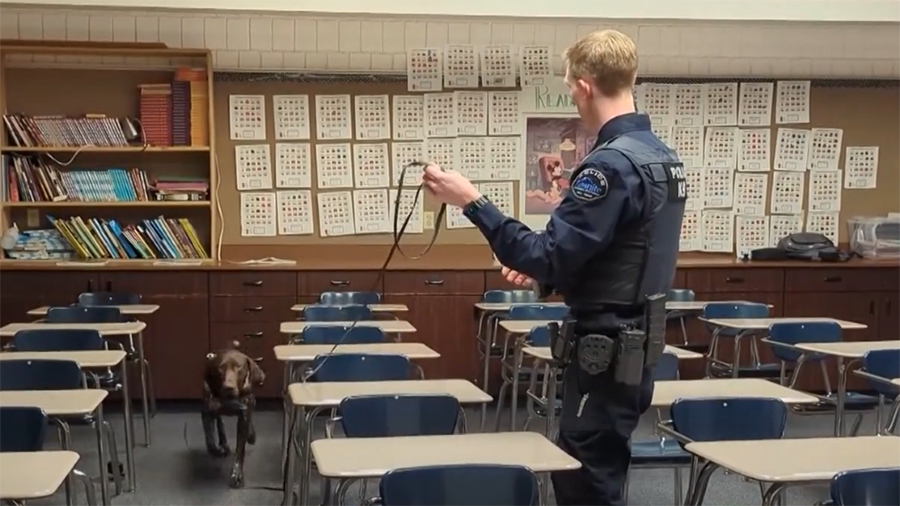

Matthew Weinstein That’s exactly the right question to be asking. Because, yeah, as you said, it’s $1.8 trillion, over 10 years, about $180 billion a year. And that’s roughly comparable to the tax cuts that we did under the Trump administration, that was about $150 billion a year. That was, you know, intended to spur investment. Now, a lot of economists now say that that didn’t give us the return on investment that we were expecting, that one didn’t give us the big boost in capital investment that we were hoping for. So the question is whether this kind of investment, similar amount that $180 billion a year, would give us the boost that we’re looking for. And the good news is that because most of the rest of the world, the countries that we compete with, globally, whether it’s Germany, France, England, Canada, the other Western industrialized, advanced free market democracies, they’ve all done this already. They are kind of ahead of us in these areas. And the result seems to have paid off pretty well for them. Their economies have done well, their middle class standard of living by a number of metrics exceeds our own, and they haven’t had to deal with the very high levels of sort of social dysfunction, that we’ve kind of gotten used to here. Homelessness and poverty, and the violent crime. You know, here in America, we have to lock up almost 1% of our population to try to keep law and order peace on the streets. Nobody else has to do that. They just don’t have that level of social dysfunction to start with. And that really goes back to poverty. And that really goes back to, are we making the kind of upfront investments that close these gaps that keep all of us able to keep our heads above water, and that’s where these kind of upfront investments really would pay for themselves in the long run.

To the extent that we can, we want the private sector to do these things on its own. That’s the ideal situation. But then you can also end up with these disparities where some people have the good jobs and the good education, and they’re able to enjoy the benefits of that, but not everyone does. And that’s where you end up with leaving people behind and having those levels of social dysfunction. You know, we’re really lucky here in Utah. We sort of stand head and shoulders above the rest of the country in a number of ways. Like our low poverty rate, low crime rates, low rates of incarceration. But as we’re becoming more diverse, which is very much to our credit, we’ve been a warm and welcoming state for immigrants and refugees. But the immigrant populations tend to have lower education levels and higher rates of single parent families, and other challenges, that our systems right now aren’t really set up to deal with as effectively as they need to be. And that’s where we need to make some of these upfront investments and take these steps, like investing more in education, investing in children, lifting them out of poverty, so that they can catch up. And we can close these gaps going forward. This is actually a good one that I like to highlight about higher education, and where we haven’t been keeping up, where historically, Utah was ahead of the nation, for college degrees and above. And that was a real backbone of our economy. And so if you look at the chart on the left, which is age 25-64, which includes the older generation, we’re still a little bit ahead of the nation for Bachelor’s degrees. But if you look at the younger generation, what you see is that among millennials, aged 25-34, we haven’t kept up with the increase nationally. This is from a report were publishing in another week or two, comparing Utah to the US and to our neighbor to the south, Arizona, by a number of metrics. But it’s good for seeing this gap here where we haven’t been keeping up in bachelor’s degrees. And so it’s not just in high school graduation, that we need to worry, we also need to be paying attention to how we’re doing in terms of higher education as well. You can see that for graduate degrees and above, we’re behind by four points, where for the whole working age, population will be behind by two, for associate’s degrees among the whole population, we’re actually ahead of the nation by a point, but among the younger generation we’re behind. So that’s an area where, you know, it’s not that we’ve fallen behind so much as the rest of the nation has moved ahead, and we haven’t kept up. And that is a question of investment. And a lot of people are afraid to run up the big debt involved with college degrees. Well, that Biden family plan is proposing to make it possible to graduate with less debt, and to get the first couple of years of college for free, which would help out with that. Now, this one is one that illustrates one of our biggest advantages, which is, our strong families in Utah. We have the lowest percentage in the country of children growing up in single parent families. So that means 81% of our kids are growing up in two parent families. Nationally, that figure is 66%. So that gives us a huge advantage over the rest of the country. And that gives us a great place to start with, so that we can address these other challenges for the future, we’re very well positioned to be able to do that, going forward, thanks to our strong family structures in a strong commitment to family.

Matt Rascon: Another issue front and center and the conversation about families and the economy is the historically low birth rates. It’s happening in Utah. It’s happening in the country and around the world.

Phil Dean: And it may surprise people but we’re actually below replacement level here in Utah. So even though our fertility rate is higher than the national average, we’re still over a lifetime, our population would decline if we didn’t have migration. So it is one of these things that we’ve always reliably had in a Utah economy, being able to rely on internal population growth. That’s not necessarily the case anymore. Now I do think it is an open question of how much any particular government program would change that. If you look at Europe, that has extensive social programs, you also see an even lower fertility rate there than what we have here in the US broadly. So I think that’s an open question in terms of how much a bill or programs like this would impact that. But it’s certainly one of those headwinds that we face here in the US economy, looking at this declining and continually declining fertility rate. And I think a lot of things play into that.

Ultimately, it gets really challenging. So as you look at this debt that we’re passing on to future generations, if there are fewer people in those future generations, how are they going to be able to manage that? It’s also an issue of jobs in the economy and consumption in the economy. All these things are tied closely with a number of people in the economy. And so I think there are a lot of questions about what the long term impact, but certainly it has a dampening effect on the economy. I mean, I think there are a lot of things that factor in and certainly incomes, I’m sure people today look at housing prices in Utah and wonder, Am I going to be able to even get a home, or if I can’t get a home, it probably needs to be smaller, because of how expensive housings become. So I think financial impacts, certainly, financial considerations certainly play an impact. But I think they’re also broader societal attitudes that also influence family sizes.

Matt Rascon: The historically low birth rates that we’re seeing, and, you know, and the challenges that that poses for the economy, you know, in the future, if it continues on that path. And do you think that this, this addresses that in some ways, or how have we seen it in other countries where, you know, more government programs don’t necessarily help with that?

Matthew Weinstein: Yeah, it’s, um, you know, it’s a tough one. But we’ve seen even here in Utah, that our birth rate has fallen since the last recession, the Great Recession, as we call it, and it just hasn’t recovered. And, you know, that tells you something, it’s clear that there’s some economic impact of children that the younger generation of parents are feeling that they have a tougher time bearing and that’s probably exacerbated by the large volume of college loans that they may have, if they went to college or went to some sort of training program after high school to get some sort of certificate or degree. And so a lot of people do believe that it’s worth trying through this sort of child tax credit expansion, along the lines of what Senator Romney has proposed, along the lines of President Biden’s proposal that would make it possible for families to be less concerned about the financial aspect, when they’re deciding to get married when they’re deciding to have kids. No, it there’s no question that it’s, it’s a historic sort of proposal. But there’s a lot of pent up demand, you know, we’ve kind of let these other countries get ahead of us on addressing these issues and getting these programs in place. And we’re kind of playing catch up at this point. And, you know, everyone’s been talking about these kind of ideas from both political parties. And it’s just that we haven’t been able to arrive at a consensus to actually do it to actually make the upfront investment to do it. Which is kind of ironic, because you know, these other countries that are doing these things, they’re nowhere near as wealthy as we are. We’re actually wealthier than just about all of them. But we just haven’t been prepared yet to make the commitment that yeah, this is worth it. This is going to give us the right return on investment, this is really going to create the better future that we want. So maybe now we’ve gotten to that point. We hope so.

Matt Rascon: So of course, the plan is just to proposal at this point, and likely has a battle ahead in Congress. So we’ll just have to wait and see. That does it for us though for this week on KSL+. We’ll see you again next week.