Utah Home Prices Jump Again, Hit Record Sales in April

May 24, 2021, 11:17 PM | Updated: Apr 14, 2023, 2:45 pm

SALT LAKE CITY – A record number of homes sold in Utah during the month of April, even as the median sales price jumped nearly 27% over the last year, according to a report released by the Utah Association of Realtors.

Buyers closed on 4,845 homes, the report said, which is the most sales for that month since the association started keeping records in 2003.

“With such strong activity, by the time a property sale closes, the market may have already moved higher than that sold prices suggests,” the April 2021 “Monthly Indicators” research report said.

The median sales price in April climbed to a record high of $425,000. For comparison, the monthly snapshot showed, one year ago, it was $335,000, and in April of 2019, the median home sales price in Utah was $315,000.

“I’ve been following the Utah housing market since the mid-1970s and the last year has been the craziest housing market I’ve seen,” said James Wood, the Ivory-Boyer senior fellow at the University of Utah’s Kem C. Gardner Policy Institute.

The number of homes actively on the market is down 64% from this same time last year. That’s less than what’s considered to be a one-month supply of inventory, the association said. A balanced market has about a six months’ supply of housing.

“What we have is a buyers’ panic and people just want to get in,” Wood said.

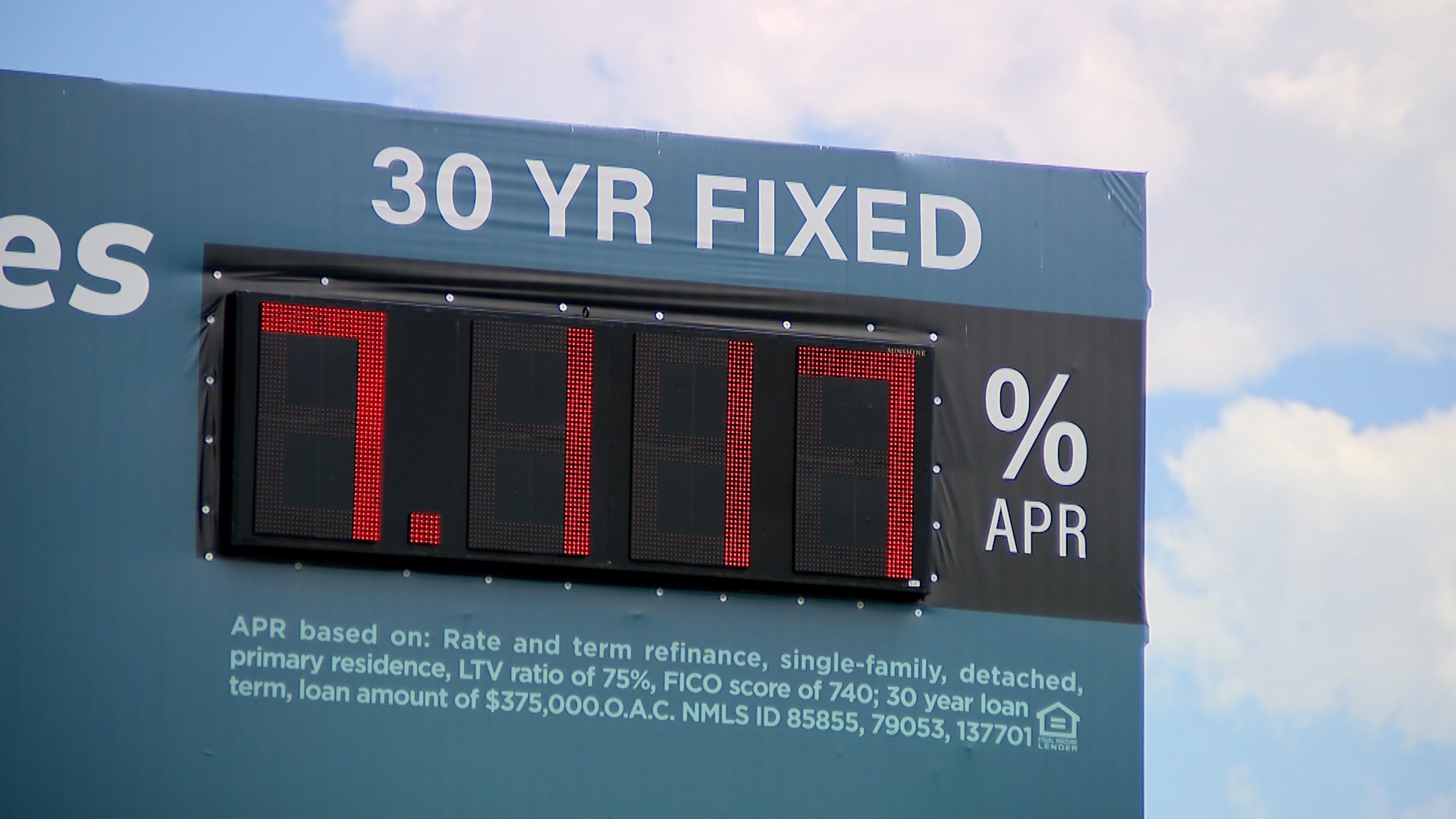

Wood said the upward pressure on home prices comes from Utah’s booming population and long-running housing shortage, combined with low interest rates that are attracting new buyers into the market.

“It’s a scary market, it’s an unhealthy market and I’m not sure how the correction is going to come — it will come,” Wood said.

The Game Has Changed

“Until you’re really in it, it’s like you don’t realize how many people are out there fighting for the same thing you’re fighting for,” said Sarah Cisneros.

The Cisneros family of South Jordan recently sold their home and bought another.

“Our motivation to move was we just wanted more house, but we really wanted a yard,” said David Cisneros.

When they entered the housing market, they soon realized that the home-buying game had changed since the last time they completed a transaction just a few years ago.

“You can see a house and then if you blink, it’s no longer an option,” David Cisneros said.

The intense competition to get an offer accepted left them feeling defeated.

“It’s so emotionally draining,” Sarah Cisneros said.

They then started working with an agent who specialized in their area and got a successful game plan.

“We were kind of done playing all of those games because we had been playing them for so long,” David Cisneros said. “I’m happy that we were able to navigate through it.”

They found and bought the home they wanted and said they learned that it’s vital to find out what’s important to the seller and craft the offer to match.

“People are not always taking the offer that’s the highest offer,” Sarah said.

Another common tactic, they learned, is to offer to lease the home back to the seller, giving them time to purchase their next home and move.

Fighting For First

“What we’re seeing right now is not sustainable,” said real estate agent Justin Hurd with Keller Williams. “It is not sustainable. It is not healthy. However, it’s the reality.”

To compete in the new home-buying reality, Hurd said buyers need to show they are serious and hassle-free by making as many guarantees as possible.

“The common conversation I’m having with most of my clients right now is, ‘Hey, we have to come to play from day one,’” Hurd said.

In order to do that, buyers need access to cash up front, he said, even if that means borrowing from a relative or 401(k).

“It’s not uncommon to see $20,000 to $30,000 of earnest money,” Hurd said, adding that making some of that up-front non-refundable money can make an offer more attractive.

“It’s just what they’re having to do to compete,” Hurd said. “That traditional way will not get you the offer today.”

Buyers also need to have their financing ready to go and should expect the seller to consider the reputation of their lender when looking over offers.

‘Rewarding’ Solution

“You really feel for these young families that are trying to get a house,” said Drew Armstrong, with Armstrong, Flinders and Associates Realtors and UtahRealEstate.net.

Armstrong said he and fellow realtor Matthew Flinders got fed up seeing some of their well-qualified buyers lose out when putting in offers for homes.

“I just said, ‘No, we’re not going to do this again,’” Armstrong said.

They’re putting some of their clients in the number-one spot by buying the house themselves, with cash, and then selling it to their clients a few weeks later. The cash-only offers mean quick transactions, which some sellers want.

“The seller was willing to sell the house for $27,000 less than another offer that they had because we could close it in less than a week,” Armstrong said about one recent purchase.

They could make more money flipping the homes for profit, but they like giving clients a fighting chance in the current housing market.

“It’s really rewarding emotionally for me, too,” Armstrong said.

One of the buyers that Armstrong and Flinders helped are the Moellers in Utah County.

“That’s not something that a typical real estate agent would do,” said Bracken Moeller.

The couple tried getting offers accepted, but with each failed offer, they watched prices keep going higher.

“We put down non-refundable earnest money, all kinds of things, and still didn’t get them,” Moeller said.

That’s when they were offered the unique solution from Armstrong.

“’I’ll just buy the house and then you can buy it from me,’” Moeller said. “It’s something I’d never heard of.”

The cash-only offer did the trick.

“Being able to turn Bracken into a cash buyer in this situation made it so his offer was accepted where it wouldn’t have been otherwise,” Armstrong said.

The Moellers then sold their existing home, moved into their new home in Lehi and quickly bought it from Armstrong and Flinders for the agreed upon price.

“We’re loving it,” Moeller said.

The couple is now enjoying their new home and the yard for their two German Shepherds. They can’t thank Armstrong and Flinders enough for going above and beyond.

“Thank you,” Moeller said. “I constantly said thank you for doing this. It’s a service. It really is.”