Unaffordable Utah: Strategies & solutions to survive the inflation storm

Nov 11, 2021, 9:21 PM | Updated: Nov 12, 2021, 9:49 am

SALT LAKE CITY — For some Utah families, even the essentials – groceries, gas and rent – have become cost-prohibitive.

That’s true for single mom Heidy, who asked us not to use her last name. Already on a budget, Heidy said her wallet is strained as prices rise, even on staples like milk and eggs.

“I have to be on top of my expenses at all times,” she explained. “I am worried because I’m already struggling as how it is.”

That has Heidy considering ways to boost her income.

“I’m working right now a 40-hour weekly shift,” Heidy said. “Sometimes it’s not enough. My paycheck is not enough. So, I get to try to find a second job just so I’m able to pay my bills.”

It’s not something Heidy would have even considered having to do a year ago.

‘Inflation is the word of the day’

The cause for the double-digit rise in many prices: inflation. The annual U.S. inflation rate has now hit a 30-year high.

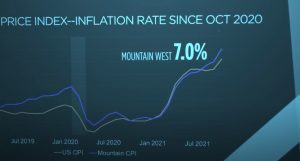

For October 2021, the Consumer Price Index increased 6.2% from a year ago. The increase was even higher in the Mountain West at 7%.

Economist Mark Vitner with Wells Fargo said it’s not going away anytime soon.

“My warning is that folks that keep saying that inflation is temporary are being unrealistically optimistic,” he opined.

Vitner worried lower-income households will be hit hardest, but just about everyone will feel the inflation sting.

“What that means for your typical household is that there’s not going to be a whole lot of real income growth,” he said.

Cost of doing business

It’s not just Utah households struggling with inflated prices.

“I’ve never seen it like this before,” lamented Samuel Oteo, owner of Lola on 9th and 9th, a Mexican bistro. “Never. We just opened six months ago, right after COVID, and it’s hard. It’s honestly really hard.”

Small businesses like Oteo’s face a one-two punch of inflation and supply chain issues.

“Chicken more than doubled,” Oteo explained. “Cilantro is close to double.”

Earlier this year, he said he could buy a case of avocados for $35, but now pays $90. A box of straws was $57. That price has more than doubled.

Plantains jumped so high in price, Oteo said he had to take the vegetarian taco option off the menu.

“I don’t know what’s going to happen,” Oteo said. “We’re in limbo. We’re hanging by a thread.”

He’s had to raise prices on his menu twice since opening to cover his increased costs. He just hopes customers understand.

“There’s obviously a few bad reviews that we’ve had because we’ve raised prices, and it’s heartbreaking, but it is what it is,” he said.

How did we get here?

Zions Bank Senior Economist Robert Spendlove said our current inflation is due to a combination of stimulus money flooding the economy, supply chain breakdowns, labor shortages, and a change in buying habits during the pandemic from services to goods.

“Broad-based, overall inflation is really something we haven’t seen in 20 years,” Spendlove explained.

When does it end?

“I think this sticks around as long as the pandemic disruptions are going to happen,” Spendlove forecasted, “and that could be into 2023.”

Other economists KSL-TV spoke with in past months gave more optimistic opinions, including Phil Dean with the University of Utah Gardner Institute. Dean told KSL-TV in July he expected to see prices mellow within six to nine months.

KSL-TV investigated other bills that Utahns may see rise. We found utility bills will be impacted.

The Utah Public Utility Commission recently approved a rate hike for Dominion Energy, allowing natural gas prices to rise “a total average net increase of $5.25 or 8.97% to the monthly bill of a typical residential customer.”

Rocky Mountain Power indicated in a press release that new rates went into effect at the start of 2021 at a 2.6% increase for customers, or about $3.08 per month on average. They have planned a more modest increase of less than $1 per month in 2022.

Many Utahns saw rate hikes in water bills during last summer’s drought. Those hikes main remain as water conservation methods continue.

Riding out the storm

“You can’t control how inflation rises and falls, but you can control your own financial decisions,” said financial counselor Amanda Christensen, an adjunct faculty at Utah State University.

Christensen said there are many ways to make hard earned dollars stretch farther.

Number one: beef up your savings account now, if possible.

“There will likely be more opportunities that you’ll need to dip into that savings in the future,” Christensen explained.

If you’re considering a big purchase, like appliances, a vehicle, or even a home, now is the time while interest rates are low. The Federal Reserve could increase interest rates by 0.25% as early as July 2022.

Taking advantage of the hot housing market and lower rates means it’s also a great time to refinance on your home to drop PMI and lower monthly payments.

In the market for a car? Christensen said not only would you save money with low-interest rate loans, families can keep more of their cash by going green.

“One of the biggest benefits for that with a vehicle is you could consider a fuel-efficient or a vehicle with better fuel efficiency, or even an electric vehicle considering where we are with the price of gas,” she explained.

Gas prices in Utah are up 59.5% for regular gas in the last year.

Rising costs don’t mean you necessarily have to work a second job to make ends meet.

“Decreasing expenses has the same effect as making more money does when it comes to your budget,” said Christensen.

After 18 months of financial strain with the pandemic, if cutting out one more thing is just too much, Christensen said you don’t have to go without.

“There’s the option to just do things a little less frequently, but still do them,” she said.

Christensen also said taking advantage of the worker shortage may be an opportunity to increase your salary by finding a better paying job or negotiating a higher salary, giving you more money to survive the inflation storm.