IRS asking some Utah taxpayers to refile their 2020 returns

Jan 31, 2022, 6:15 PM | Updated: Jun 7, 2022, 3:13 pm

SALT LAKE CITY — Utah taxpayers who paid their taxes almost a year ago say they’re now getting letters from the Internal Revenue Service, asking them to file their 2020 returns immediately. When a Utah man received one of the letters out-of-the-blue, he didn’t believe it was legit, so he contacted the KSL Investigators.

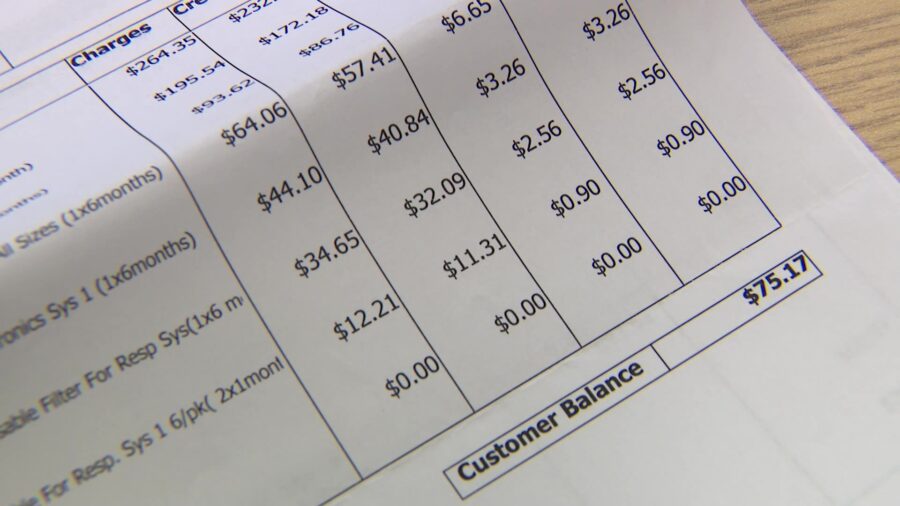

The letter Rick Robinson received seems to be from the IRS. It says he has an IRS credit owed to him, worth more $3,000. To claim it, he merely needs to file his 2020 tax return. But that is something he did nearly a year ago.

“I put the check right with my tax return and sent it in,” Robinson said.

Robinson owed money in 2020. In fact, he paid the exact amount the IRS now says they owe him. He thought it was some sort of glitch, until he asked around.

“It didn’t bother me until I found out my neighbor got this letter,” Robinson said. “I found out my sister got this letter, then it bothered me.”

Bothered enough, Robinson decided it was time to call the KSL Investigators.

As we began digging, we found that the IRS owing people who haven’t filed their taxes is more common than you might think.

Every year, millions of folks who did not file are due a refund. And it is big money — people owed billions that they need to file their returns to claim. But Robinson did file, so what is going on?

“It does look like the standard IRS form,” said Steve Washburn, a spokesman for the IRS.

“Rick says he paid his taxes in 2020, and he got this letter saying that he didn’t,” KSL’s Matt Gephardt told Washburn. “Is there a legitimate reason that could be?”

“If it’s 2020, it’s going to be a disaster,” Washburn responded. “2020 was a rough year for the IRS.”

You will probably remember 2020: multiple stimulus payments, changing tax codes, under-staffing. All that added up to a massive backlog. To this day, millions of folks who filed their taxes on paper are still waiting for their 2020 returns to be processed.

“If you filed with paper, there’s just a massive backlog of those tax returns,” Washburn said.

Sure enough, Robinson said he did file a paper return in 2020. It seems his, along with so many others, is stuck in the works.

The letter asks people who already sent in their returns to send them in again, so that is what Robinson plans to do.

“I guess I’ll just send a newly signed one and move on my way,” he said.

As to why the IRS says they owe Robinson, the agency would not talk specifics about his case. Stands to reason the IRS cashed his check, and once they finally get around to finishing his paperwork, they will realize they do not owe him anything after all.

Since our story aired, the IRS has provided KSL with some updated information regarding the letter Rick Robinson received.

Called a CP80 Notice, it is typically sent to taxpayers for whom the IRS has received payment but not a tax return.

The IRS says if you received such a notice for your 2020 taxes, do not refile your tax return. However, if you received a CP80 notice for your 2019 taxes, then it is necessary for you to refile your 2019 taxes.

More information can be found at this link to the IRS.gov website.