Retirees get creative with budgeting as inflation soars

Feb 28, 2022, 2:49 PM | Updated: Jun 7, 2022, 2:58 pm

KAYSVILLE, Utah – Record inflation, spikes in gas, groceries, and utility costs are bad news for Utah retirees. A fixed income can make it much harder to cope.

A financial expert has practical solutions for seniors.

For 42 years, Sarah Voigt taught 2nd grade. “That’s my favorite grade. They’re so eager to learn,” said Voigt, who lives in Kaysville.

She’s retired and on a fixed income while the cost of living soars. “The prices go up almost every time you go. Just a chuck roast was $40, so I just really pondered whether I was going to do that or not,” she said.

It’s a problem many seniors face. Social Security benefits for 2022 went up 5.9% starting last December. But consumer prices increased 7.5% last month, the highest jump since 1982, and are still rising, according to the U.S. Department of Labor,

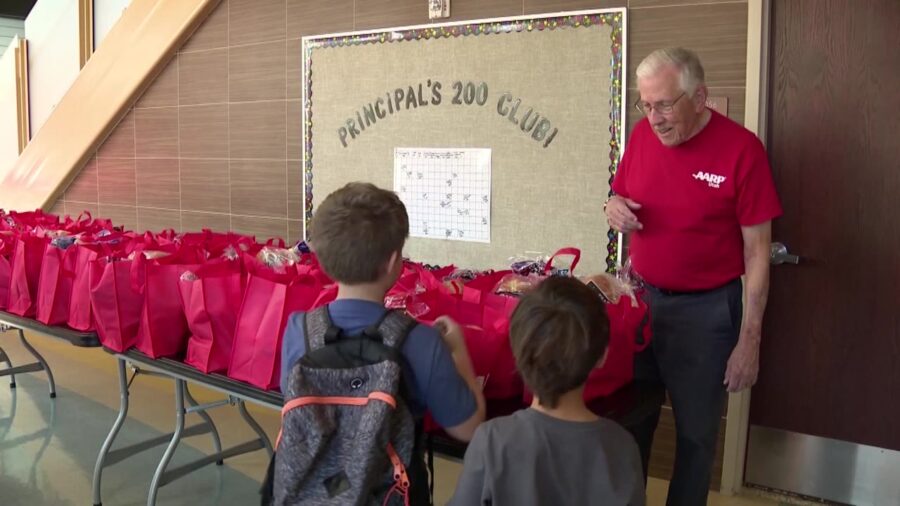

“We have to prepare for that,” said Martin Booker, Program Manager of Financial Resilience Programming with AARP.

MARTIN BOOKER’S FINANCIAL RESILIENCE PROGRAM

Create a fluid budget, one you update often.

List your income and expenses, factoring inflation, and make sure to be thorough.

“Every little expense that comes in, we want to make sure we capture it, so the small coffee break that we take, right where we go and pick up a coffee, we want to make sure that that’s in the budget.

Find ways to stretch your income like food banks and sales to lower your grocery costs, and consider cheaper options for services. “Places like hair schools, or nail schools, you know, beauty and cosmetology schools, these are places where you can get cheaper services done by students with, with really good quality as well,” Booker said.

Look for ways to increase your income. “Small entrepreneurial endeavors that may allow you to make a few, a few dollars,” Booker said. Experts suggest decluttering your house and selling items online, but be wary of scams. Or, look for part-time work you can do from home.”

If Social Security is your fixed income, and you have made it to the full retirement age, you are able to work and make as much money as you possibly can, with no penalty to your Social Security benefit.

“Voigt said. “I try to go to the clearance rack or the sale rack.”

Voigt braced herself for more increases. “It’s going to get worse, I think, before it gets better.”

She also brings some wisdom. “There was a time when things just weren’t quite right, and I made it through then.”

There are many resources to help older Utahns during this tough economy.

LINKS FOR BUDGETING HELP

AAA Fair Credit.

Utah Department of Workforce Services

Utah Division of Aging Services

For immediate assistance, dial 211, or click here.