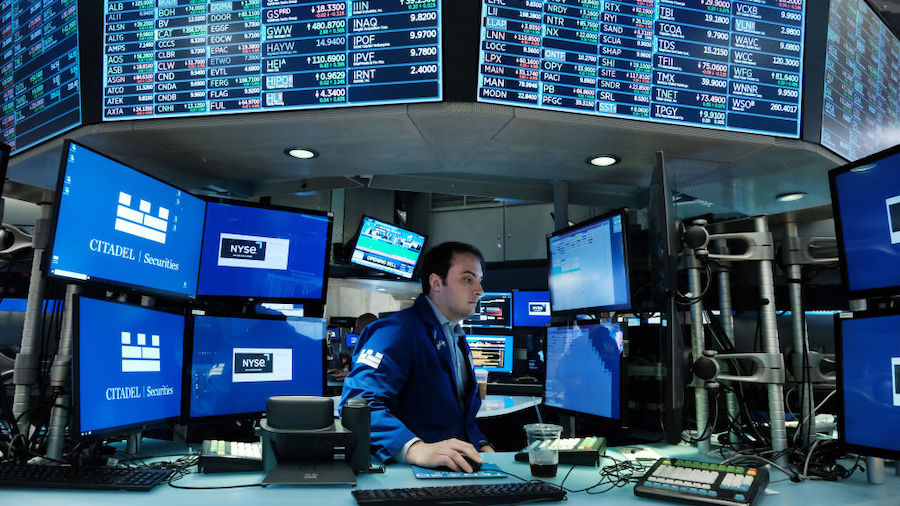

NEW YORK (AP) — Wall Street is falling further Tuesday in its first trading after tumbling into a bear market on worries that high inflation will push central banks to clamp the brakes too hard on the economy.

The S&P 500 was 0.9% lower in afternoon trading as investors brace for the Federal Reserve’s announcement on Wednesday about how sharply it will raise interest rates. Earlier in the day, it wobbled between modest losses and gains after a couple big companies flexed financial strength with stronger profits and payouts to shareholders.

The Dow Jones Industrial Average was down 289 points, or 0.9%, at 30,2226, as of 2:50 p.m. Eastern time, and the Nasdaq composite was 0.4% lower after swinging between a gain of 1.1% and a loss of 0.4%.

Trading across markets was mostly calmer, if still tentative, following Monday’s worldwide rout, which sent the S&P 500 down 3.9%. Stocks fell more than 1% in Tokyo and Paris but rose that much in Shanghai. A measure of nervousness among investors on Wall Street was easing, even as Treasury yields remained near their highest levels in more than a decade.

“No one’s going to take meaningful positions today ahead of what could be a rip-roaring day” with the Fed’s announcement, said Katie Nixon, chief investment officer for Northern Trust Wealth Management.

Cryptocurrency prices continued to swing. They’ve been among the hardest-hit in this year’s sell-off for markets as the Federal Reserve and other central banks raise interest rates to rein in inflation and forcefully turn off the “easy mode” that helped prop up markets for years. Bitcoin was down 4.3% in afternoon trading and sitting at $22,207, according to CoinDesk. It fell overnight to nearly 70% below its record of $68,990.90 set late last year.

Offering some support to the market was a report that showed inflation at the wholesale level was a touch lower in May than expected, though it remains very high. It could be an indication that wholesale inflation peaked in March, according to Jack Ablin, chief investment officer at Cresset Capital Management.

But economists said the data won’t keep the Federal Reserve from hiking its key interest rate on Wednesday by a larger-than-usual amount. Investors are now largely expecting the biggest increase since 1994, a hike of three-quarters of a percentage point, or triple the usual amount.

A week ago, such a mega-increase was seen as only a remote possibility, if one at all. But a market-bludgeoning report Friday on inflation at the consumer level has seemingly pinned the Fed into getting more aggressive. It showed inflation for the consumer price index got worse in May, instead of slowing as hoped.

““It’s really a split decision in terms of the market as to whether that will be a good thing or a bad thing,” Nixon said of a big rate increase. “It certainly opens the door to additional big hikes in the future.”

Treasury yields were churning and near their highest levels in more than a decade. They also had a relatively reliable warning signal of recession in the bond market flashing on and off.

In afternoon trading, the yield on the two-year Treasury had fallen back below the 10-year yield, at 3.43% versus 3.48%. That’s typically how things look in the bond market.

In the unusual circumstances where the two-year yield tops the 10-year yield, some investors see it as a sign that a recession may be hitting in about a year or two. It’s called an “inverted yield curve,” and it’s been flashing on and off intermittently over the last day.

On Wall Street, Oracle soared 9.2% after it reported stronger revenue and earnings for its latest quarter than analysts expected. FedEx jumped 13.3% after it boosted its dividend payout by more than 50%.

It was the first trading for U.S. stocks after the S&P 500 closed Monday at 21.8% below its record set early this year. That put it in a bear market, which is what investors call a drop of 20% or more.

At the center of the sell-off is the U.S. Federal Reserve’s effort to control inflation by raising interest rates. The Fed is scrambling to get prices under control and its main method is to raise rates, but that is a blunt tool that could slow the economy too much and cause a recession.

“The real calm in today’s market is driven very significantly by the focus on this week’s Fed decision.” said Greg Bassuk, CEO of AXS Investments. “Today’s is either the calm before the storm or the calm that will hopefully represent an extended period of calm.”

Other central banks worldwide, including the Bank of England, have been raising rates as well, while the European Central Bank said it will do so next month and in September.

The war in Ukraine is sending oil and food prices sharply higher, fueling inflation and sapping consumer spending, especially in Europe. COVID infections in China, meanwhile, have led to some tough, business-slowing restrictions that threaten to restrain the world’s second-largest economy and worsen snarled supply chains.

The shift by central banks, especially the Fed, toward higher interest rates has reversed the spectacular rise in stock prices spurred by massive support for markets after the pandemic hit in early 2020. The S&P 500 more than doubled from late March 2020 thorugh its peak in January. It was the shortest bull market on record going back to 1929, which followed the shortest bear market on record, according to S&P Dow Jones Indices.

Higher interest rates typically make investors less willing to pay high prices for risky investments. That’s why some of the biggest stars of the earlier low-rate era have been some of the worst hit in this year’s rout, including bitcoin and high-growth technology stocks. Netflix is down more than 70% in 2022.

___

AP Business Writer Yuri Kageyama contributed.