Too risky to insure? Why your homeowner’s insurance could go up in smoke

Jun 27, 2022, 10:26 PM | Updated: 11:29 pm

SUMMIT PARK, Utah — There are good reasons insurance companies drop customers from their homeowner’s policies: non-payment, not taking care of the property, or too many claims.

None of that applied to Peter Ingle, who has lived in his home nestled in the forests of Summit Park for 25 years.

In August 2021, his neighborhood was evacuated when faulty parts on a passing vehicle sparked the Parley’s Canyon Fire off Interstate 80. The fire burned more than 500 acres.

Thousands Evacuated, I-80 Impacted As Multiple Crews Battle Parleys Canyon Fire

The wildfire triggered a visit from Ingle’s homeowners insurance company, Allstate, shortly thereafter.

“My insurance company called and said they’re coming out to just check out the areas around our homes to make sure they’re sort of fire safe,” Ingle said . “We didn’t think much of it.”

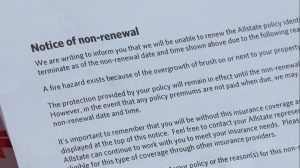

In November 2021, Ingle said he got bad news: Allstate was dropping his insurance.

Ingle called his insurance agent, who assured Ingle he was working with Allstate to change their minds.

When February came around, Ingle’s agent still didn’t have good news.

“He goes, ‘The reality isn’t your property, it’s the adjacent that’s the problem,” Ingle explained.

In the letter sent to Ingle from Allstate, the reason given for non-renewal was “overgrowth…on or next to your property.”

“I was pissed off,” Ingle said. “I was mad.”

Ingle said he was careful over 25 years to make sure his yard had defensible space, keeping trees neatly trimmed and away from the house. Unlike his neighbors, he even had a lawn.

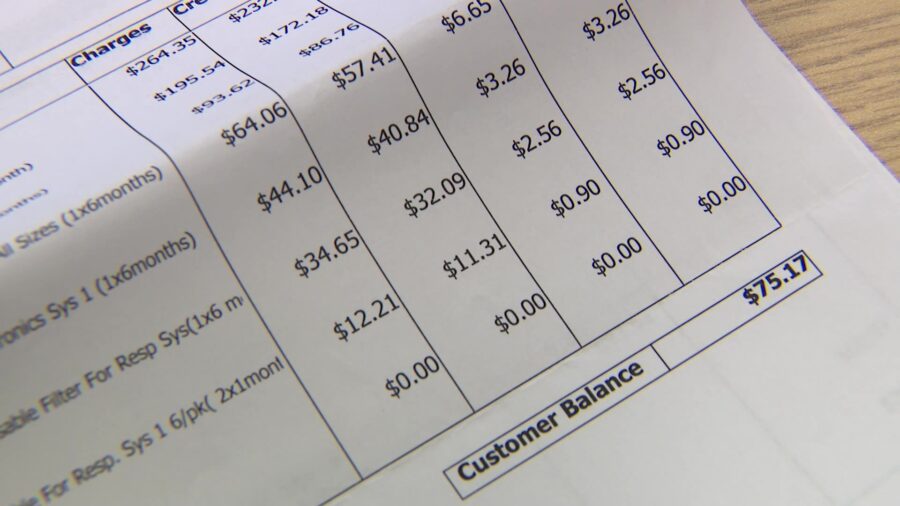

He said he was never given an opportunity to address issues on neighboring properties. Instead, when his Allstate policy dropped in April, he was forced to find a new policy with a different company. Fortunately, his new policy had the same coverage and was slightly cheaper than Allstate.

Big fires are a big risk for insurance companies

We reached out to Allstate on Ingle’s behalf. In an email, their spokesperson told us, “because we protect customers and their privacy, we do not share specific policy information and decisions.”

We also offered to get written permission from Ingle to talk about his situation but received no response.

Instead, we took Ingle’s situation to Carole Walker, executive director of Rocky Mountain Insurance Information Association. Walker said Allstate didn’t do anything against the rules.

“Every insurance company is going to look at that individual property risk for wildfire and decide whether that’s a risk they can take on,” she said.

Fire risk across much of the Intermountain West is no longer limited to remote cabins in the woods. As drought deepens and homes expand into the wildland-urban interface, more Utahns are finding themselves living in high-risk areas.

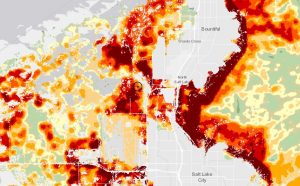

The Wasatch Front is no haven from that risk. According to RiskFactor.com, 87% of all Utah properties—more than a million homes—are at some risk for wildfire over the next 30 years.

Looking at the Utah Wildfire Risk Assessment map from the Utah Division of Forestry, Fire, & State Lands, places like Cedar City, Lehi, Riverton, all-mountain bench communities, and even parts of the Great Salt Lake shoreline in North Salt Lake have “extreme” wildfire risk.

That risk could impact the ability for thousands of Utahns to get homeowners insurance.

“It’s going to take more shopping for insurance,” Walker said. “You may not keep the insurance that you’ve always had, especially if you’re in a higher risk area. You may even be pushed into what we consider a higher risk marketplace.”

The case in California

Insurance companies dropping out of the market altogether is something already happening in California, a state plagued with deadly, catastrophic fires over the last several years.

“Could that happen in states like Utah? Yes,” said Walker.

After the 2018 Camp Fire destroyed nearly 20,000 homes and killed hundreds in Paradise, California, residents all over the state in high-risk fire areas found themselves getting letters like Ingle’s, telling them their insurance was being dropped.

According to the California Insurance Commission, nearly 100,000 homeowners saw their policies not renewed in 2019, a 70% increase from the year before.

California’s government decided to act, and in 2018 created a one-year moratorium on insurance companies canceling or non-renewing insurance policies in high-risk wildfire areas. This was enacted in late 2019 with the governor’s declaration of a state of emergency. Commissioner Ricardo Lara has extended that moratorium every year since.

After implementation of that moratorium, California saw a 19.8% decrease in non-renewals in zip codes affected by that moratorium.

The Utah Insurance Commission does not track how many Utahns have been dropped from insurance, so it is unclear how often this has happened in our state.

California is one of 32 states and Washington, D.C. that offer state-funded insurance plans to people in high-risk areas of severe weather and natural disasters. Utah is not one of them.

Walker cautioned that steps taken by California may not be the best idea, as many insurance companies have pulled out of their market altogether.

“Insurance companies have a responsibility to all of their policyholders, no matter what type of risk you live in,” Walker explained.“They need to be able to take in enough premiums to pay out claims when we have thousands of homes burn, when we have large catastrophic events, which we’re seeing more and more of.”

However, depending on how bad wildfire years get, Walker admitted Utah may end up needing to institute a state-funded insurance plan to help those in high-risk areas.

Safeguarding your home against wildfire risk

The Utah Division of Forestry, Fire, and State Lands has tips on things homeowners can do to mitigate wildfire risk.

You can view these tips, along with explanations of the ways homes burn in a wildfire, by visiting their brochure here.

Have you experienced something you think just isn’t right? The KSL Investigators want to help. Submit your tip at investigates@ksl.com or 385-707-6153 so we can get working for you.