Student loan forgiveness was ‘dangled in front of us:’ How 700,000 borrowers were cut out of Biden’s plan

Oct 22, 2022, 4:03 PM

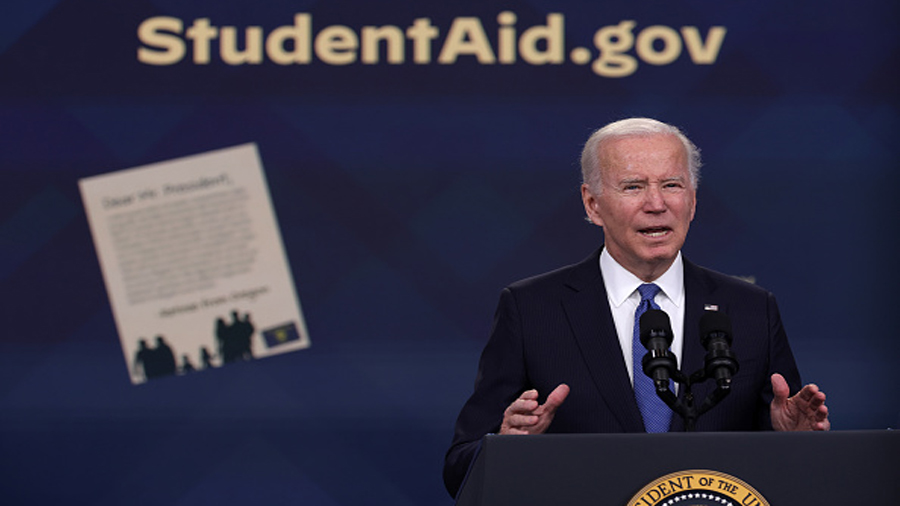

President Joe Biden speaks on the student debt relief plan in the South Court Auditorium at the Eisenhower Executive Office Building on October 17, 2022 in Washington, DC. (Alex Wong/Getty Images)

(Alex Wong/Getty Images)

(CNN) — Michael Christofield was excited when he found out he was eligible for $10,000 in student loan forgiveness under President Joe Biden’s new plan. The debt relief would help him pay off his loans by the time his children go to college.

“I’d be in a position to help them in a way my parents weren’t able to help me,” he said.

But before the application was launched, the Biden administration abruptly scaled back the program. As a result, an estimated 700,000 people with a certain kind of federal loan — including Christofield — lost eligibility for debt relief.

“It was dangled in front of us,” Christofield, 43, said.

The move affected borrowers with older federal loans that, through no fault of their own, are held by private lenders instead of the government. The loans are at the center of a lawsuit making its way through the courts, challenging the legality of Biden’s debt relief program.

Biden administration officials have repeatedly said that they are assessing whether there are alternative pathways to provide relief to these borrowers, but the application for the program officially opened Monday without any update.

The administration is “moving as quickly as possible to provide relief to as many people as possible,” Education Secretary Miguel Cardona said at a press conference Monday.

However, an appeals court ruling Friday temporarily paused the program, delaying relief while it considers a challenge to the loan cancellation plan. The administration had said it would begin granting student loan discharges as early as Sunday.

Who’s left out?

The eligibility change, announced on September 29, excluded federal student loans that are guaranteed by the government but held by private lenders.

Many of these loans were made under the former Federal Family Education Loan program, known as FFEL, and Federal Perkins Loan program.

Generally, borrowers didn’t have the opportunity to choose whether to take out a federal loan held by the government or one held by a private lender. The FFEL program ended in 2010, so borrowers who took out loans after that date likely have Direct Loans that qualify for debt relief. Often, the FFEL and Perkins loans are serviced by the same companies that service the federal Direct Loans.

The federal government bought some loans from the FFEL program during the Great Recession. But about 4 million of the 43 million federal loan borrowers still currently have a FFEL loan owned by a private lender — though not all of those people were likely initially eligible for the loan forgiveness plan, which also includes an income requirement.

Estimating how many of those borrowers were eligible relies on assumptions about their income as well as how many would apply for the relief. The Biden administration has said around 700,000 people lost eligibility.

Many borrowers with privately held federal loans feel like they keep getting the short end of the stick. Their loans also do not qualify for the pandemic-related pause on payments and interest that began in March 2020.

Borrower frustration: ‘This can’t be happening’

Some borrowers with privately held federal loans may still qualify for forgiveness under Biden’s plan. But they must have applied to consolidate their loans into federal Direct Loans before September 29 — roughly five weeks after the program was announced.

Paulo Calderon said he immediately considered consolidating his FFEL loans in order to qualify for the debt relief. But when he called his loan servicer, it was unclear that consolidating was the best option for him.

“I was actually told there was no guarantee that consolidating would qualify me for loan forgiveness,” said Calderon, 45, who owes about $26,000 in student debt.

There are risks to consolidating. It could have increased his interest rate, raising the amount owed each month. Plus, the application for debt relief had not launched yet and the Biden administration said borrowers would have until December 2023 to apply.

Calderon continued to research and was leaning toward consolidating — but didn’t take action before reading a news article on September 29 about the change in eligibility. He called his servicer again that day, but it was too late to consolidate.

“It was so frustrating. I was like, ‘This can’t be happening,” Calderon said.

Why are some loans treated differently?

The Biden administration changed the eligibility criteria on the same day six GOP-led states sued, claiming the President does not have the legal authority to erase student debt.

The states also argued that student loan servicers — including the Higher Education Loan Authority of the State of Missouri, known as MOHELA — are financially harmed by Biden’s student loan forgiveness plan. The lawsuit argued that the plan creates an incentive for borrowers to consolidate Federal Family Education Loans owned by MOHELA into Direct Loans owned by the government, “depriving them (MOHELA) of the ongoing revenue it earns from servicing those loans,” according to the lawsuit.

By excluding these borrowers from the program, the Biden administration likely weakened the plaintiffs’ argument.

On Thursday, the judge dismissed the case, ruling that the states did not have the legal standing to bring the challenge. The states immediately appealed, sending the case to the 8th Circuit Court of Appeals where it is likely to face a panel of conservative judges.

Who still qualifies for debt relief?

Under Biden’s plan, eligible individual borrowers who earned less than $125,000 in either 2020 or 2021 and married couples or heads of households who made less than $250,000 annually in those years will see up to $10,000 of their federal student loan debt forgiven.

If a qualifying borrower also received a federal Pell grant while enrolled in college, the individual is eligible for up to $20,000 of debt forgiveness.

Federal Direct Loans, including subsidized loans, unsubsidized loans, parent PLUS loans and graduate PLUS loans, are eligible.

While borrowers with FFEL and Perkins loans who have kept paying their bills on time remain ineligible, defaulted federal loans taken out under any program are eligible.

The application for forgiveness can be found online here.

The-CNN-Wire™ & © 2022 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.