Can a tax code amendment help Utahns conserve water?

Oct 26, 2022, 2:38 PM | Updated: Nov 18, 2022, 6:17 pm

Riley Niederhauser, a Salt Lake City Public Lands Department crew member, repairs sprinklers in Liberty Park in Salt Lake City on July 7. A new analysis published by the Utah Rivers Council Wednesday critiques the state's water district property tax, but water suppliers say it's crucial for funding water projects. (Kristin Murphy, Deseret News)

(Kristin Murphy, Deseret News)

SALT LAKE CITY — As ongoing drought conditions continue to pummel the West, a Utah water conservation advocacy group believes a tweak in the state’s tax code can be a major driver toward water consumption reduction goals according to a story at KSL.com.

Public records show that Utah charges much more in property taxes than at least 11 other states in the West, the nonprofit Utah Rivers Council found in a new analysis published Wednesday. The council argues that the taxes subsidize the cost of using water, which results in overconsumption. The report comes as Utah lawmakers again ponder a revision to the tax code that would remove a water district’s ability to collect property tax, as the state looks at ways to conserve water and send more water to the ailing Great Salt Lake.

“Phasing out the property tax is the most inexpensive way to not only save water by reducing water demand, but it’s also the most inexpensive way to increase water to the Great Salt Lake,” said Zach Frankel, Utah Rivers Council executive director. “It just lets the free market dictate use. … Price dictates use.”

But administrators of the state’s largest water suppliers contend that property tax collection can play a vital role in funding new water infrastructure, repairing Utah’s aging water infrastructure or even other types of projects that also reduce water consumption.

Laura Briefer, Salt Lake City Department of Public Utilities director, hasn’t seen the report; however, she is well aware of the push to remove property taxes based on previous and rekindled efforts in the Utah Legislature. She’s concerned that removing the tax and increasing rates could price some residents out of being able to afford basic water service.

At the same time, Briefer asserts that taxes make it easier for Utahns to budget their water use by knowing the cost upfront. That’s also the case for water utilities as they plan for the near future.

“Removing another tool in the toolbox does not serve the public (and) does not serve our aging water infrastructure,” she said. “We really need to think this through.”

Water property tax in Utah vs. the West

Utah water districts have the ability to assess property tax on homes, businesses and vehicles among those in their districts, which isn’t unique to the West. Most Western states allow water providers to collect property taxes that can be used for infrastructure projects. Utah lawmakers say about $160 million is annually collected through these taxes.

However, the Utah River Council says Utah’s collection rate dwarfs others in the region. The group has long criticized the state’s low water-use costs; its report compares Utah’s water property tax collection and water price rates to nine other states, from Texas to the Pacific Northwest, leaving out Idaho and Wyoming because of the inability to match public records. In all, the council analyzed information from 342 water districts.

It found that people in Utah pay a lot of their water bills up-front, compared to other states in the region. Key findings in the report include:

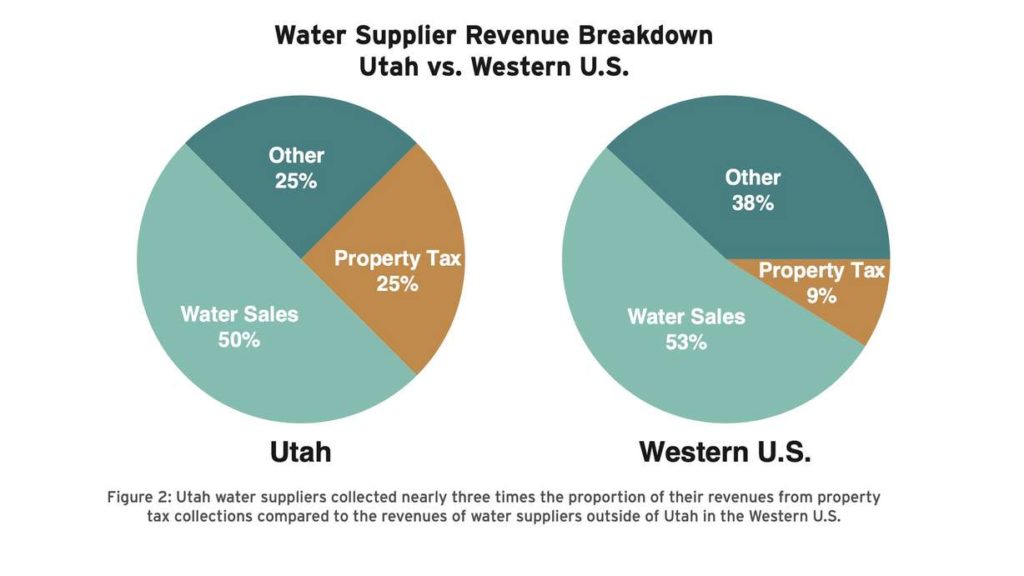

- Property taxes account for about a quarter of revenue collected by the average Utah water district, nearly three times the average of the neighboring Western states.

- Utah’s five largest water districts collected about $132.6 million in property taxes in 2020, about $49.3 million more than 100 of the largest water districts in seven Western states combined that same year.

- Conversely, Utah cities have vastly lower water use costs compared to other cities in the West because of steeper property taxes. For instance, a Salt Lake City resident might pay $2.80 per 1,000 gallons if they used as much as 30,000 gallons in July, based on the use cost provided to the group. It would cost a Denver resident $5.86 per 1,000 gallons using the same amount of water. St. George’s rate of $2.30 per 1,000 gallons is also much lower than $5.51 in Las Vegas.

This graphic, created by the Utah Rivers Council, breaks down an average of Utah water district revenues compared to nine other Western states based on the group’s analysis of 342 water districts. (Photo: Utah Rivers Council)

Frankel argues that this is a problem because it’s the origin of a cycle that encourages water waste, especially when the majority of municipal water ends up being used for outdoor watering. Water districts collect property taxes up front and then lower the cost of water that Utahns use, which results in overconsumption because of the cheap cost to use water, which results in more water spending to compensate for the consumption that creates “excessive levels of debt on taxpayers.”

The report suggests that Utah could incentivize water conservation just by removing Utah’s water property tax collection and adjusting the cost of water to account for the revenue loss. As Frankel puts it, Utahns would have the choice to use the money they save from lower property taxes on maintaining the amount of water they currently use or choose to use less water and spend that money elsewhere.

He believes many Utahns would choose to use less water if it costs more, comparing it to what happened when inflation jacked up the price of gas this summer. AAA reported in July that nearly two-thirds of Americans surveyed said they changed their driving habits to account for higher gas prices — most said they did so by driving less than they normally would.

There’s no definitive way to know how much water Utah would save by removing the property tax, though. The report puts 2015 Utah water use statistics with a 2011 University of Utah study on the projected economic reaction of removing the tax in Salt Lake County, which is the most recent data available because of accuracy concerns.

While some of the figures may not reflect current use, Frankel still estimates the action would reduce somewhere in the ballpark of 20% of all municipal water use, keeping more water in reservoirs, or, in northern Utah, freeing it to go to other places like the Great Salt Lake.

A legislative battle brewing

This is actually an idea the Utah Legislature has already heard and is ready to revisit.

Just last week, Sen. Dan McCay, R-Riverton, unveiled a draft of a possible bill that would amend the state’s water property tax code to remove a water district’s ability to charge property tax. He believes the change is necessary because some entities like schools, churches or nonprofits don’t pay property taxes and can be some of the largest water consumers among municipal users, creating a major loophole in the system.

“The idea here was by shifting away from property tax and putting water at a usage fee only, it really captures the purpose of really where I think water conservation and water use are in line,” McCay said during a Utah Legislature Revenue and Taxation Interim Committee hearing last week. “You may end up paying that same amount, depending on your usage, because the water districts are going to adjust their rates to pay for those capital projects that they’ve invested there.”

The Utah Rivers Council report also mentions this. The report names government institutions and wealthier homeowners as winners with the current law, while lower-income users are left paying a larger percentage of their overall income on property tax payments.

However, this type of legislation has been proposed a few times in the past two decades and has failed every time. Rep. Joel Briscoe, D-Salt Lake City, who supports the bill, said the discussions previously derailed as water districts and wholesalers pleaded that changing the system would make it difficult to repay bonds on major water infrastructure projects and wouldn’t result in any changes.

The same issues also stalled McCay’s bill from moving forward last week. He plans to file an amended bill to the committee next month, addressing bond concerns before the measure is possibly weighed in the upcoming legislative session.

The proposed bill has the support of Rusty Cannon, president of the Utah Taxpayers Association, but is already facing scrutiny again from water providers who view the tax in a different light.

Take Salt Lake City as an example. Crews replaced part of a century-old water line near the Utah Capitol earlier this year to help account for all the growth downtown, but that’s just the tip of the iceberg. Briefer says the city faces about $2 billion in foreseeable projects just to keep the current infrastructure up to snuff.

While the city currently doesn’t collect property taxes on water, it’s something that might be necessary in the future, especially if there’s no clear revenue from water use rates. Briefer said that while residents conserved more than 2.5 billion gallons of water last year — something that is good in a drought — it did result in $17 million in lost revenue for the department.

“(This) means then that we have to make really hard decisions to defer needed aging infrastructure replacements,” she said. “So there’s always this balance in our rate structure of incentivizing conservation but also making sure that we have the revenue coming in to take care of the infrastructure.”

It’s not just deteriorating infrastructure that could be a problem. Sometimes the issue is balancing new growth or even catching up to new government regulations.

Water suppliers add that this is a bigger concern for smaller cities that may not have a large enough population to balance the loss of property taxes with use rates. Many local governments turn to bonds to help finance the remaining portions of the money needed to complete a project.

“Water financing is multifaceted and that’s the thing I feel like is lost in the proposal and the narrative right now. We really need to think hard about the decisions and what a wholesale change in water financing options would do to the state of our water infrastructure,” Briefer said. “Having that property tax revenue removed by Jan. 1, 2023, doesn’t give us the time to take a deep dive that we need to take on water financing issues and what the most pressing needs are in the state.”

Mark Stratford, a representative for Prepare 60, a group composed of the four largest water districts in the state to support future water infrastructure planning, told the committee last week that the water districts in the group also oppose the bill. He said that these property taxes can be used not just for infrastructure projects but to provide incentives like removing water-thirsty turf grass, which can also reduce consumption.

There is at least “some relevance” to the argument brought up by those pushing for property tax reform, Briefer says. Reducing water consumption does have the ability to alter the costs for some future projects.

She said Salt Lake City decreased enough of its water consumption habits over the two-decade-long megadrought to reduce the size and cost of the city’s new sewer treatment plant; however, cutting back may mean very little for current infrastructure in the state that needs repair now or in the future.

Frankel says he’s heard all these arguments before and he isn’t convinced. At the same time, he views it as a much simpler and more cost-effective solution to ongoing water issues than other proposals, such as an ocean or other pipeline to refill the drying Great Salt Lake.

As the battle over the tax reignites among lawmakers for about the half-dozenth time, he’s cautiously optimistic that a better review of the current property tax law will result in a change this time around.

“There’s always hope for us and our organization,” Frankel said, referencing the shift in tone about water over the past few years. “The question is going to be whether the state legislators are going to be receptive and embracive of free market economics.”