Unaffordable Utah: Shift your budget to combat inflation

Feb 14, 2023, 7:51 AM

SALT LAKE CITY — After battling high inflation for nearly two years and a rollercoaster of gas prices, experts say it’s time for Utahns to make some budget shifts to survive the persistent higher prices.

“The best advice I can give anybody right now is to focus on paying down high-interest debt,” said Amanda Christensen, a personal finance professor at Utah State University Extension. “Rather than the spend, spend, spend mentality brought on by the pandemic.”

Even though there is some light at the end of the inflation tunnel, Christensen said relief isn’t coming soon enough.

“It feels like an ongoing battle,” she said of the higher prices.

Get intentional about budget

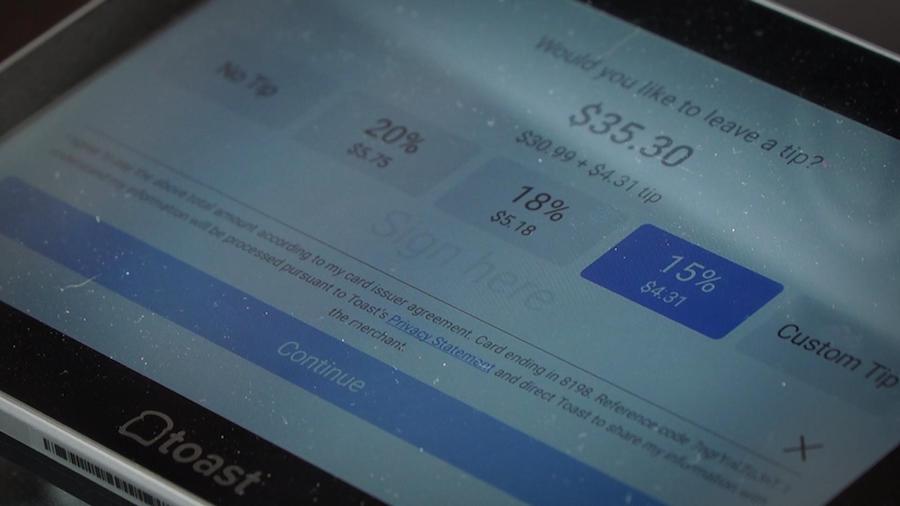

“Eating out is just so expensive,” said Shantelle Cleverley, a busy mom of four who lives in Cedar Fort.

Cleverly said higher prices almost everywhere and living in a small town have made her and her husband even more focused on outsmarting inflation.

“For me, it’s like, ‘OK, I have to get intentional,” she said. “It’s just little things that add up.”

Cleverley said she’s saving gas by carpooling, combining trips and only driving when necessary.

“I was spending a ton of money in gas, so just by carpooling I’ve halved that,” she said.

The strategy requires planning ahead, like using online grocery shopping. She said filling her cart online helps her stick to her budget by adjusting the cart before checkout without interference from the kids.

“Meal planning and grocery pick up have been my two magic things,” Cleverley said.

Save with meal planning and DIY services

With the price of meat skyrocketing she makes sure nothing goes to waste with meal planning.

“If I do a roast or ham or something on Sunday, I can use those leftovers and incorporate those into other meals to stretch out my meals farther,” Cleverley explained.

Cleverley is cooking from scratch and cutting back on convenience foods. She’s also baking bread and muffins at home — a smart move since dairy and baked goods are driving food inflation.

“Lots of things that you can start making instead of buying at the store,” she said. “If there’s something that you use or your kids like and find some way to do it for free or super cheap then that gives room in your budget for other things.”

Here’s another budget hack: find services that you can do yourself. As wages increase, we’re paying more for services like deliveries, pet care, dry cleaning and haircuts.

“The services sector is something that the Fed is really nervous about,” Zions Bank senior economist Robert Spendlove told KSL after the January inflation report. “We continue to see very high wage inflation. Last month (December) it was 4.6% so that’s driving the cost of overall services much higher.”

Take control and step it down

To take control of your finances, Christensen recommends starting with reconnecting with those old-fashioned dollar bills. The simple tactic will have a big impact as you watch where your money is going.

“Take cash and remember what it feels like to hand over the physical dollars,” she said. “It just sort of creates a mindset that I think we’ve lost a little bit with credit card swiping.”

As an accredited financial counselor, Christensen said the next step is to look for all those reoccurring charges — which will probably surprise you. Reevaluate those monthly subscriptions for TV streaming, clothes, cosmetics and food.

“Somewhere along the line I have given people permission to pull money right from my checking account,” she said. “What’s the total that’s going out in monthly subscriptions every month and is that serving your family’s best interest?”

Don’t stop there, examine your entire budget and focus on a few areas.

“Where am I spending the most?” Christensen said. “Pick a category and say, ‘Can I step it down in one area?’”

That doesn’t mean eliminating your favorite things or entertainment. Just stepping down the frequency or cost. She said to consider movie matinees with fewer expensive snacks or preparing coffee or your favorite soda at home instead of buying it at the drive-thru.

Increase income and decrease expenses

Since we can’t control inflation, Christensen said to remember that increasing income and decreasing expenses are the two things in our control. With wages going up, she said a side gig could really pay off right now

“Time to sort of hunker down,” Christensen said.

Finally, once you’ve hacked your budget, Christensen said the right mindset will keep you on track.

“I often tell people to adopt a money mantra. Mine is: I have what I need. What I have is enough.”

Christensen said more ideas on how to save money can be found in the Utah State University Extension’s Cutting Expenses guidebook.