Utah bill seeks to help first-time homebuyers

Feb 23, 2023, 7:05 PM | Updated: 8:56 pm

SALT LAKE CITY — A bill making its way through the Utah Legislature would create a first-time homebuyer assistance program.

“In America, we believe in home ownership and in Utah, we believe in home ownership,” Senate President Stuart Adams, R-Layton said.

Adams is sponsoring SB240 which would create the assistance program using $50 million. The proposed funding is enough to help with the purchase of 2,500 homes in Utah.

Adams said that without assistance many families would not be able to make the jump into homeownership.

“We may be losing our middle class,” he said. “Most of people’s net worth is in their home. The security and stability, I think, economically and emotionally comes from property ownership.”

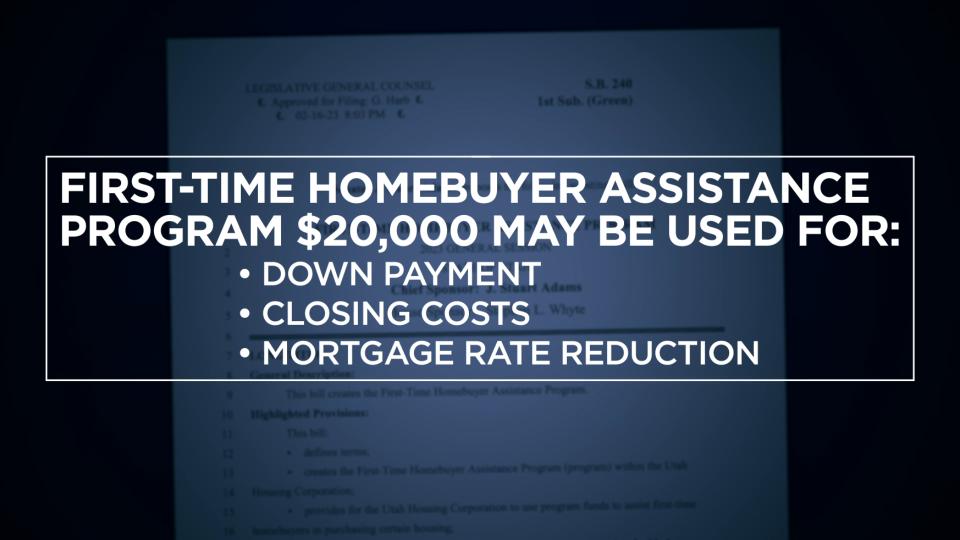

Under the program, those buying a home for the first time could get a loan up to $20,000 that could be used for the down payment, closing costs or to buy down the mortgage interest rate.

“It remains a lien on the house,” Adams explained. “So, if they happen to get a better rate or they want to refinance at some point in time it has to be paid back. Or if they sell the home it needs to be returned.”

To qualify for the loan, the home, condo, or townhome must be located in Utah and be new construction, or newly constructed but not yet inhabited, and priced under $450,000. The home must also be occupied by the owner upon purchase.

“The program assists families and individuals across the state get out of apartments and into homes while encouraging home builders to construct affordable housing,” Adams wrote in an opinion article for the Deseret News. “By doing this, we are helping address Utah’s housing shortage and providing an opportunity for families to build equity.”

SB240 passed the Senate Wednesday and now heads to the Utah House of Representatives for consideration.

Realtor Stephanie Grable said the program could help more first-time buyers enter the market who have been priced out by higher interest rates and higher home prices.

“Being able to buy down that rate to increase their purchasing power is going to be huge,” Grable said. She works with The Stern Team at Keller Williams.

While the details haven’t been finalized on how the proposed program would be administered, Grable said she likes the flexibility and that it helps first-time homebuyers keep crucial money in their pockets.

“Now we get them into the home they have money for repairs and they have money for furniture and they have money to start that life in this beautiful new home that they just purchased,” she said.