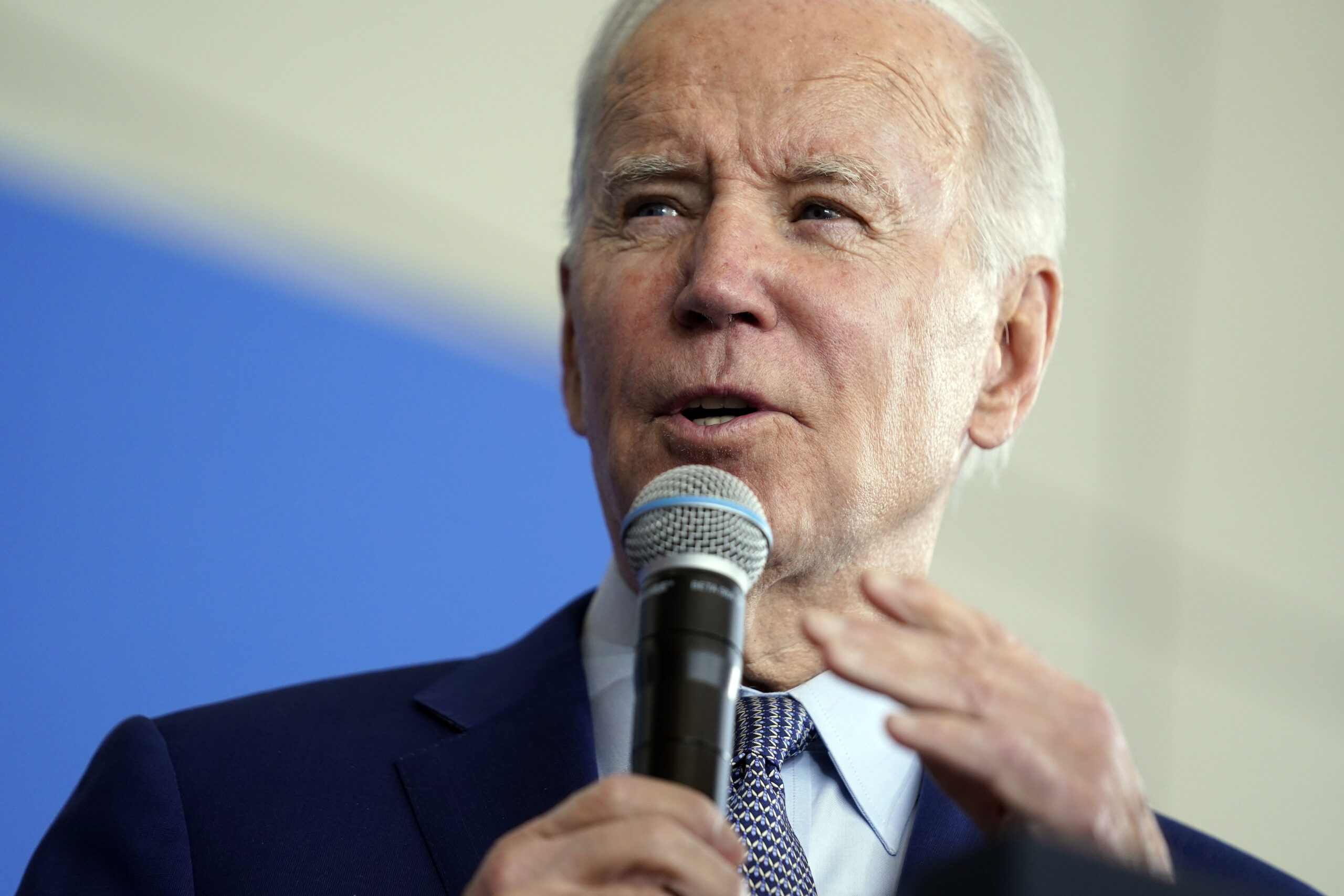

WASHINGTON (AP) — President Joe Biden on Friday called on Congress to allow regulators to impose tougher penalties on the executives of failed banks, including clawing back compensation and making it easier to bar them from working in the industry.

Biden wants the Federal Deposit Insurance Corporation to be able to force the return of compensation paid to executives at a broader range of banks should they fail, and to lower the threshold for the regulator to impose fines and bar executives from working at another bank.

He called on Congress to grant the FDIC those powers after the failures of Silicon Valley Bank and Signature Bank sent shockwaves through the global banking industry.

“Strengthening accountability is an important deterrent to prevent mismanagement in the future,” Biden said in a statement. “Congress must act to impose tougher penalties for senior bank executives whose mismanagement contributed to their institutions failing.”

Currently the FDIC can only take back the compensation of executives at the largest banks in the nation, and other penalties on executives require “recklessness” or acting with “willful or continuing disregard” for their bank’s health. Biden wants Congress to allow the regulator to impose penalties for “negligent” executives — a lower legal threshold.

Congress has already begun to address the aftermath of the bank failures.

On Friday, the House Financial Services Committee’s top Democrat, Rep. Maxine Waters of California, said in a letter to regulators that while she is crafting legislation to give regulators more authority, “it is critical that your agencies act now to investigate these bank failures and use the available enforcement tools you have to hold executives fully accountable for any wrongful activity.”

The Justice Department, Security and Exchange Commission, Federal Reserve, the California state regulator of Silicon Valley Bank and several congressional committees have announced some form of investigation into the bank failure.

Additionally, a group of Senate Democrats on Thursday introduced the Deliver Executive Profits on Seized Institutions to Taxpayers Act, which would claw back profits made by bank executives on the sale of stocks and compensation bonuses earned within 60 days of a bank failure, among other things.

And Sens. Jack Reed (D-R.I.) and Chuck Grassley (R-Iowa) reintroduced legislation this week to strengthen the SEC’s ability to crack down on violations of securities laws.

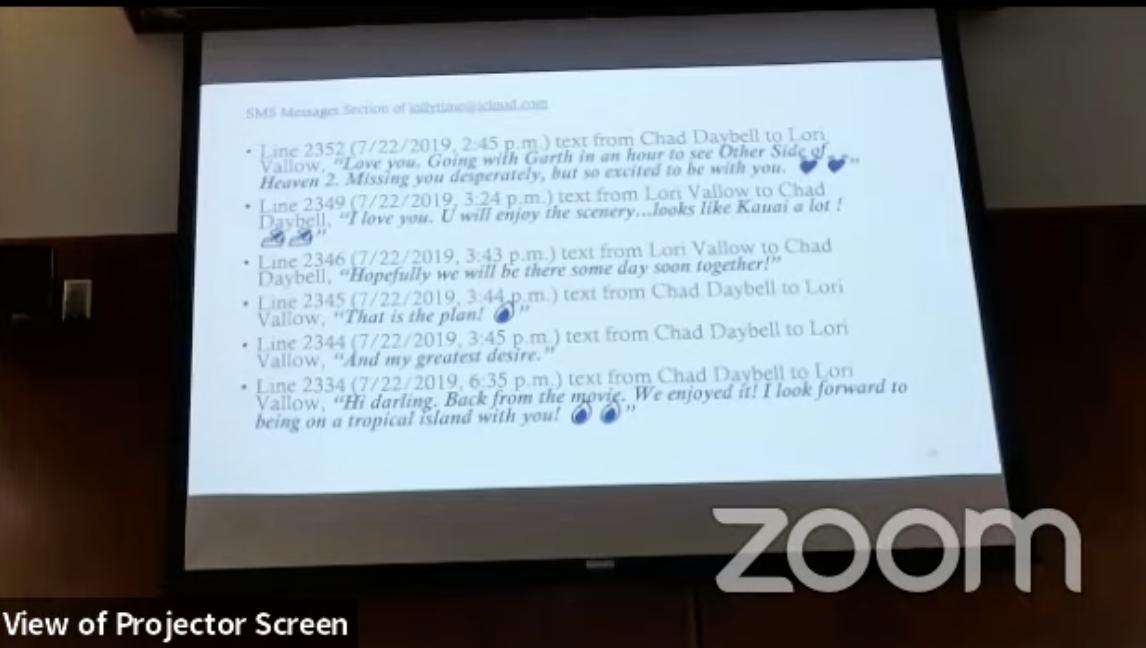

The White House highlighted reports that Silicon Valley Bank CEO Gregory Becker sold $3 million worth of shares in the bank in the days before its collapse, saying Biden wants the FDIC to have the authority to go after that compensation.

The shuttering of Silicon Valley Bank on March 10 and of New York’s Signature Bank two days later has revived bad memories of the financial crisis that plunged the United States into the Great Recession about 15 years ago.

Over the weekend the federal government, determined to restore public confidence in the banking system, moved to protect all of the banks’ deposits, even those that exceeded the FDIC’s $250,000 limit per individual account.

Sen. Sherrod Brown, D-Ohio, who chairs the Banking Committee, welcomed Biden’s call for congressional action, stating in an email that his committee “will be looking at all the ways we can protect working families’ money from risky bets that didn’t pay off in Silicon Valley or on Wall Street.

“That includes holding accountable the executives who ran this bank into the ground and the regulators tasked with overseeing them, and it includes working to reform our laws to better protect workers, small businesses, and taxpayers from corporate greed.”

John Core, an accounting professor who specializes in executive compensation and corporate governance, questioned whether increasing the authority of regulators was the right move, since “in the case of Silicon Valley, it’s not yet even clear who is to blame” for the bank’s collapse.

“So many people think it was a regulatory failure, or it was because of rapid increases in interest rates due to inflation,” he said.

Dennis Kelleher, president of Better Markets, a nonprofit that advocates for tougher financial regulations, said the White House was right to encourage Congress to act.

“Regulators simply must have a full arsenal to severely punish faithless, irresponsible and reckless bank executives, officers and directors,” Kelleher said.