Despite on-time payments, woman’s credit score drops due to company not reporting

Jun 1, 2023, 12:25 PM | Updated: 12:27 pm

DEWEYVILLE, Utah —Tiffanie Reed blamed a divorce for some bills going unpaid, which tanked her credit score.

To rebuild it, she bought an SUV from Lucky’s Auto Credit in October 2019, and made regular, on-time payments.

“I made the decision to go with them because they promised to help me rebuild my credit score,” Reed said.

The SUV now nearly paid off, Reed said she was never late on a single payment. Yet it seemed to have no impact on her credit score.

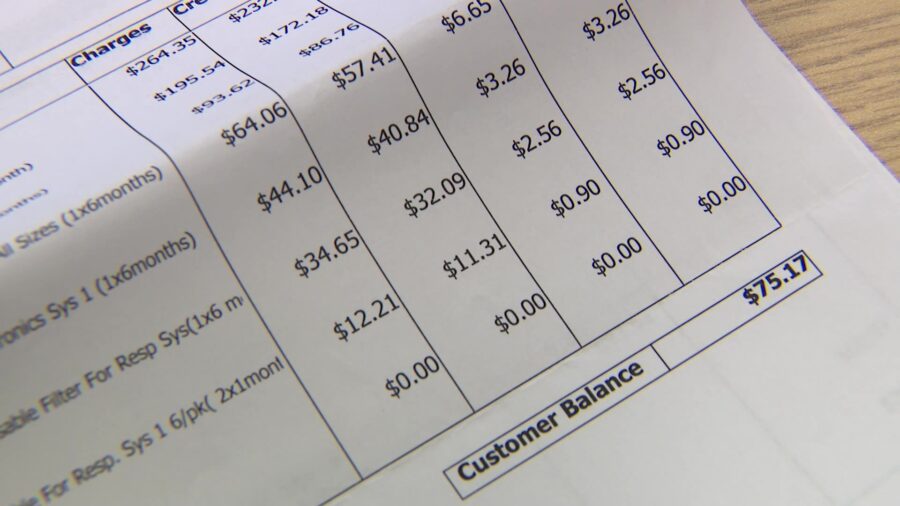

“The finance company for my vehicle stopped reporting my payments for 14 or 15 months,” Reed said.

Reed noticed the reporting stopped in January 2022. They payments don’t show up as delinquent, they just don’t show up at all.

Listed as “no data” on her credit report, her balance on the loan reflects what was owed back when reporting stopped.

“I’m doing my part, but they’re not doing their part,” Reed lamented.

She reached out to the dealership, which told her a computer glitch was to blame.

“They basically tell me that there’s nothing I can do and that I need to dispute it with the credit bureaus.”

Reed did that, and while the balance got updated, the “no data” for each monthly payment entry on the loan remained.

“I just want them to fix it,” said Reed. “I want my credit score restored.”

KSL Investigators reached out to Lucky’s Auto Credit and their in-house lender, Titanium Funds, to ask why Reed’s payments were not being reported.

In a statement, Titanium Funds’ spokesperson reiterated “technical issues” while migrating their systems to a “third party software provider that facilitates credit reporting.”

That third party company, Solera, responded that “reporting to credit agencies is handled directly by the dealership.”

Both companies assured us any credit reporting issues should be resolved in coming weeks.

As we dug deeper, we found that consumers not getting credit for credit they paid is a fairly common issue.

The federal agency in charge of monitoring consumer credit, the Consumer Financial Protection Bureau (CFPB), wouldn’t comment on Reed’s situation specifically, but pointed to several blog posts about it.

Their suggestion for Reed and anyone else in a similar situation: file a complaint with them so they can investigate.

As for Reed, she’s hopeful that the companies eventually report her on-time payments to the nation’s credit bureaus, like she was promised when she bought the car.

“It’s affecting me in so many ways that it’s frustrating, you just want to scream, but it doesn’t do any good,” Reed said.

Titanium Funds and Solera indicated the glitch was fixed, and migration is nearly complete, after which “the past payment history will be included in the data reported.”

Have you experienced something you think just isn’t right? The KSL Investigators want to help. Submit your tip at investigates@ksl.com or 385-707-6153 so we can get working for you.