Stocks Claw Back Ground On Wall Street

Mar 13, 2020, 8:49 AM | Updated: 8:50 am

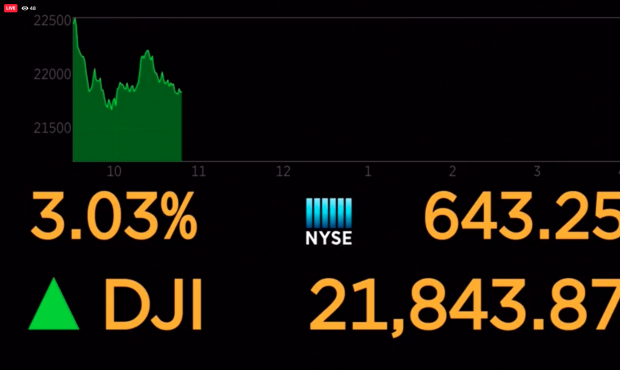

The DOW jumped hundreds of points Friday

Stocks are clawing back some of their recent losses Friday at the end of a brutal week of selling as the spreading coronavirus heightened fears of a global recession.

The early rally for U.S. stocks follows the worst slide for the market since the Black Monday crash of 1987.

The Dow Jones Industrial Average rose 900 points in morning trading, a 4.7% gain. That’s less than half of what the index lost a day earlier.

The benchmark S&P 500 index climbed 4.7%. Major indexes in Europe climbed between 4% and 5% a day after one of their worst drops on record.

Bond yields moved broadly higher, a signal some investors were pulling back, at least for now, from seeking less-risky assets. The yield on the 10-year Treasury note rose to 0.91% from 0.85% late Thursday. It had never been below 1% before last week.

The rally follows news that the Trump administration and House Democractic leadership are close to announcing an agreement on a coronavirus aid package aimed at reassuring anxious Americans by providing sick pay, free testing and other resources.

Treasury Secretary Steven Mnuchin said Friday morning that negotiations were going very well. “I think we’re very close to getting this done,” Mnuchin said, appearing on CNBC.

Ryan Detrick, senior market strategist at LPL Financial, said it appears that the government is inching closer to a stimulus plan that will help cushion the financial impact to people and businesses.

“We’re finally getting that a little late to the party, but it’s better to be late to the party then not to come to the party,” he said.

Even with the early gains, the stock market is on track for its worst week since October 2008, during a global financial crisis. In just a few weeks, U.S. stocks have wiped out all the gains made during 2019 — one of the best years for the market in decades.

The market’s rout intensified this week amid a torrent of cancellations and shutdowns around the globe as governments and businesses attempted to stem the spread of the outbreak. On Thursday, Disney said it would close its theme parks in the U.S., one of many closures by businesses that have fueled fear that a severe pullback in consumer and business spending will tip the U.S. economy into a recession and wreck corporate profits this year.

The wild swings this week have come as governments stepped up precautions against the spread of the new coronavirus and considered ways to cushion the blow to their economies.

More central banks, including those of China, Sweden and Norway, stepped in to support bond trading, a day after similar interventions from the Federal Reserve and the European Central Bank.

The Federal Reserve unexpectedly cut its benchmark interest rate by half a percentage point last week. On Thursday, it unveiled a massive short-term lending program to try to help smooth trading in U.S. Treasurys. Many economists expect the Fed will move to cut interest rates by a full percentage point, to nearly zero, at its meeting of policymakers next Wednesday.

Markets worldwide have been on the retreat as worries over the economic fallout from the coronavirus crisis deepen.

The gains in Europe were the latest chapter in a period of remarkable volatility for financial markets, with major indexes plunging into bear market territory at record pace.

Australia’s market jumped 4.4% after state and territorial leaders agreed to raise spending to counter the impact of the viral outbreak that has spread from central China across the globe, infecting 128,000 people.

Losses narrowed in mainland China, where communities are recovering from the worst of the virus. The Shanghai Composite index fell 1.2%.

Benchmarks in Japan, Thailand and India sank as much as 10% early in the day, but India’s Sensex gained 3.3% in afternoon trading. In Bangkok, the Thailand SET fell 1.3% after its 10% plunge triggered a temporary suspension of trading.

The sell-off on Wall Street Thursday helped to wipe out most of the big U.S. gains since President Donald Trump took office in 2017.

The S&P 500’s drop put it way over the 20% threshold for a bear market, officially ending Wall Street’s unprecedented bull-market run of nearly 11 years.

“Between the lack of a strong U.S. fiscal response and the latest travel ban for arrivals from Europe to the U.S., global markets appear to have been tipped over into a sell-everything mode,” Jingyi Pan of IG said in a commentary.

Not all markets have suffered equally, but many are down by double-digits from just weeks earlier. Thailand’s SET has lost nearly 40% and the Philippines’ benchmark is down more than 30%.

Overriding concerns about the actual impact on business and trade is pessimism over how the crisis is being handled, with the “sum of all fears are culminating with the view that policymakers remain well behind the curve,” said Stephen Innes of AxiCorp.

Despite the slight improvements in some markets, gloom prevailed in Asia on Friday. Tokyo’s close was its lowest in nearly four years. South Korea’s Kospi sank 3.4%..

The worldwide rout has come amid cascading shutdowns and travel restrictions across the globe — including Trump’s suspension of most travel to the U.S. from Europe — and rising worries that the White House and other authorities around the world can’t or won’t counter the economic damage from the outbreak any time soon.

For most people the new coronavirus causes only mild or moderate symptoms, such as fever and cough. For some, especially older adults and people with existing health problems, it can cause more severe illnesses, including pneumonia. The vast majority of people recover from the virus in a few weeks.

Initially, many hoped the virus would be contained in China. But as the damage and disruptions from the outbreak mount, the combined health crisis and the market retreat have heightened fears of a global recession.

Just last month, the Dow was boasting a nearly 50% increase since Trump took the oath of office on Jan. 20, 2017. It officially went into a bear market on Wednesday, finishing down more than 20% from its all-time high. For the S&P 500, this is the fastest drop since World War II from a record high to a bear market.

In other trading, the oil market, which suffered huge shocks a week ago as Saudi Arabia and Russia clashed over output cuts, was recovering some ground. U.S. benchmark crude rose 3% to $32.45 a barrel.

___

The Associated Press receives support for health and science coverage from the Howard Hughes Medical Institute’s Department of Science Education. The AP is solely responsible for all content.