Utah housing expert predicts pullback in activity because of mortgage rates

Jun 13, 2022, 6:16 PM | Updated: 8:19 pm

SALT LAKE CITY – An expert in Utah’s housing market expects that rising mortgage rates will cause a pullback in real estate activity and a slowdown in home price increases.

“That will have an effect, it will slow things down,” said James Wood, the Ivory-Boyer senior fellow at the University of Utah’s Kem C. Gardner Policy Institute.

Wood said the home price increases that Utah has experienced over the last five years were unsustainable.

“Frankly, we’ve had a very unhealthy housing market over the last several years—it’s just gone up too fast,” Wood said. “We’ve priced a lot of renters and new households out of homeownerships.”

Freddie Mac released the latest mortgage survey last Thursday and showed mortgage rates jumping ahead of inflation news and this week’s Federal Reserve meeting.

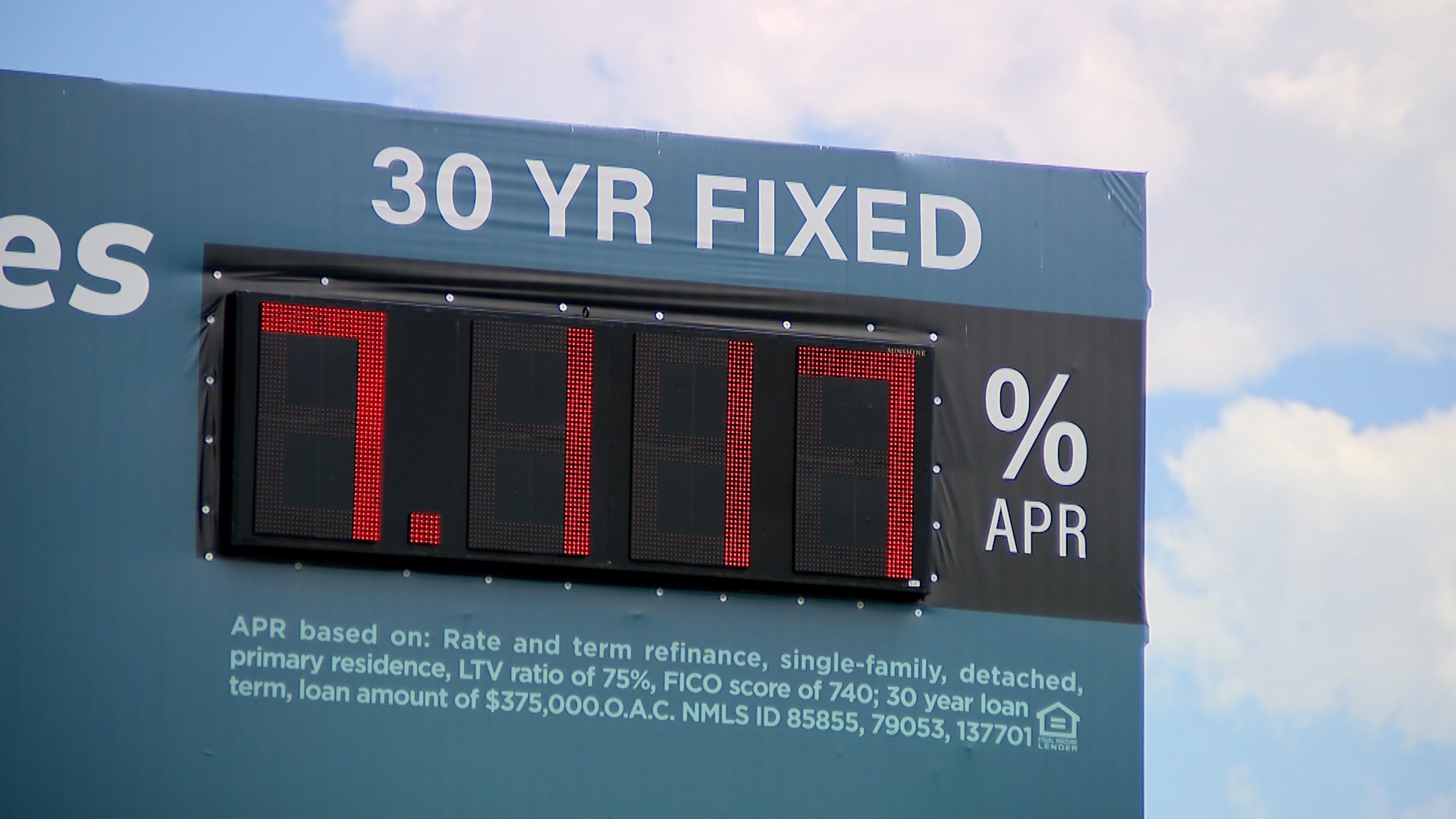

The Primary Mortgage Market Survey showed that the 30-year, fixed-rate mortgage now averages 5.23%, compared to 5.09% a week earlier.

“After little movement, the last few weeks, mortgage rates rose again on the back of increased economic activity and incoming inflation data,” said Freddie Mac’s chief economist Sam Khater in a prepared statement.

The survey said at this time last year, the 30-year, fixed-rate mortgage averaged 2.96%

“The housing market is incredibly rate-sensitive, so as mortgage rates increase suddenly, demand again is pulling back,” Khater went on to say. “The material decline in purchase activity, combined with the rising supply of homes for sale, will cause a deceleration in price growth to more normal levels, providing some relief for buyers still interested in purchasing a home.”

So far this year, Wood says homes in Utah are only staying on the market for an average of six days, but he expects the market to retreat in terms of activity for the rest of the year.

“I don’t think we’re going to see housing prices drop, but I think we’re going to see a deceleration in price increases,” Wood said. “It’s been a hot market right up to this point, the first week or two in June, but it’s going to cool off with interest rates almost at six percent.”

Wood also said he’ll be watching new home construction closely since it that sector was already struggling with labor and building material shortages.

Stocks fell sharply on Monday ahead of this week’s Federal Reserve meeting as some analysts are predicting the Fed will raise interest rates more aggressively to control inflation.