Unaffordable Utah: In A Pinch? Here’s How Emergency Cash Options Stack Up

Feb 4, 2019, 10:26 PM | Updated: May 21, 2023, 4:00 pm

SALT LAKE CITY, Utah — In a report released last year, the Federal Reserve found 40 percent of Americans lack enough savings to cover an unexpected $400 bill.

This year, the partial government shutdown showed how desperate some federal employees were to raise cash to pay bills. Federal workers appealed for help on the crowdfunding website GoFundMe; they went to food banks, and some tried to cover their expenses with either part-time jobs, or freelance work.

There are a number of ways to raise emergency cash, but financial planners said some are better than others.

Payday Loans

Daniel Love, 27, found himself with a budget that just didn’t work.

“My rent is $960, my car payment is $125, my gasoline bill runs between $50 and $60,” said Love.

His expenses often outpaced his monthly income of $1,800. He turned to payday lenders to make up the shortfall, but he couldn’t afford to pay them off right away. The interest quickly ballooned.

“Four hundred percent, holy crap,” said Love.

Rolling over the loans kept pushing up his balances, until he owed nearly $2,000. He eventually turned to a credit counselor to help him consolidate his debt and pay off the loans.

Rolling over the loans kept pushing up his balances, until he owed nearly $2,000. He eventually turned to a credit counselor to help him consolidate his debt and pay off the loans.

Love said he won’t turn to payday loans again.

“Because once you get into that cycle, once they get their meat hooks into you, it’s very hard to break that cycle,” Love said.

But payday industry spokesperson Wendy Gibson said payday loans can be a useful tool for people in some situations.

“To kind of bridge the gap in between paydays if they’re experiencing a cash shortfall, an unexpected expense, like a car repair,” said Gibson, who works for Utah Consumer Lending Association.

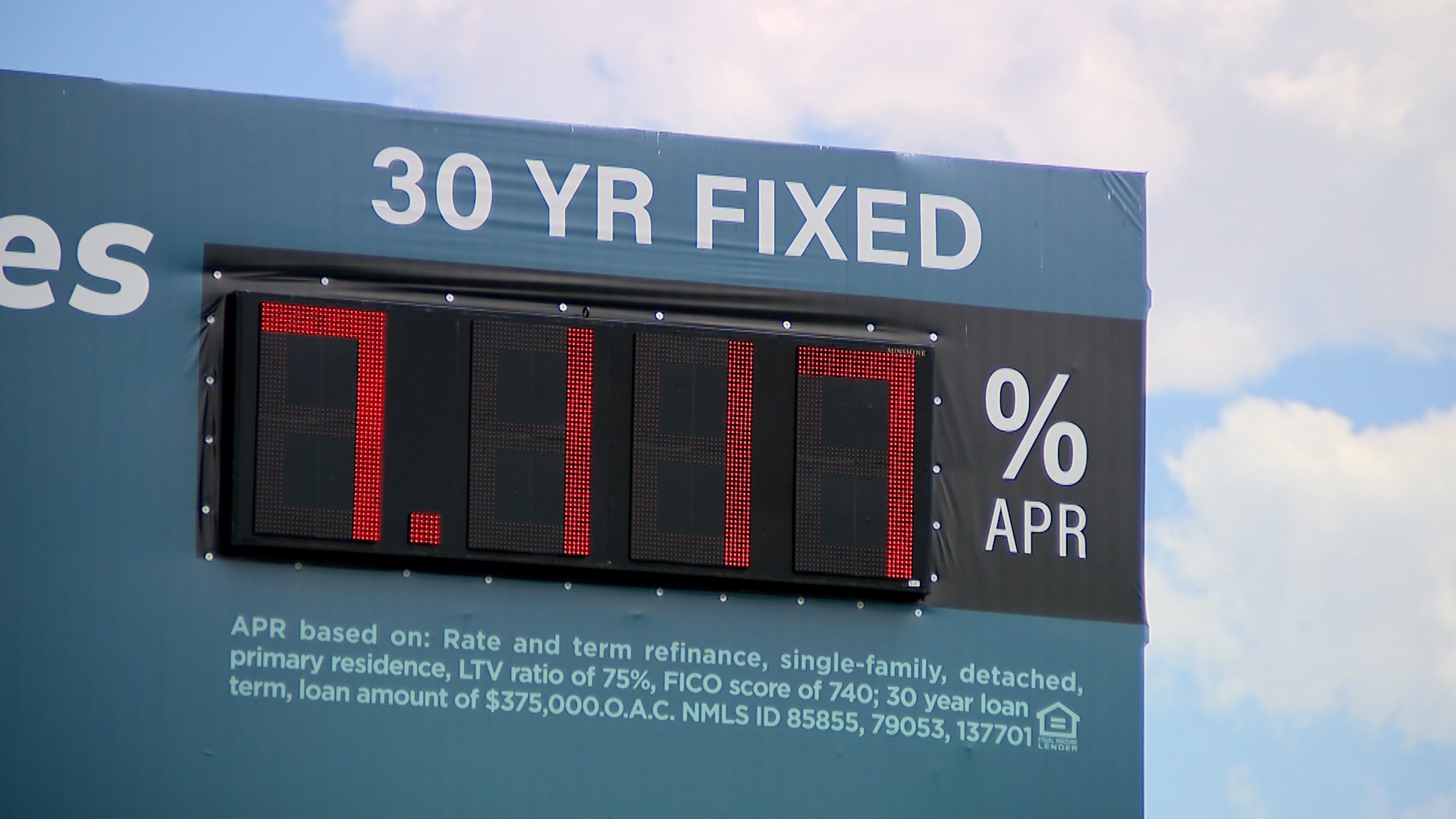

Gibson acknowledged payday lenders charge high interest rates, the average APR in Utah is 527 percent according to a state report, but she said the interest on a short-term loan may still be cheaper than bouncing checks.

“If you compare the cost of credit against, let’s say, an overdraft protection program at my bank, the cost is $39. If I were to go into overdraft, I repay my bank. After one week on $100 overdraft, the APR is 2,033 percent. But the bank is not required to disclose that in the form of an annual percentage rate,” said Gibson.

KSL calculated the cost of a $400 two-week payday loan. At the state average of 527 percent, a customer would be charged $81 in interest. Depending on a person’s financial situation, the interest may be cheaper than bouncing a check, or missing a rent payment.

Certified Financial Planner Shane Stewart ranks payday loans low on the list of emergency cash options.

“Probably one of my last resorts,” said Stewart.

He said a payday loan may not be the best option if a person doesn’t know when they’ll have a steady paycheck again.

“It’s the defaulting on the payday loan. If a job loss or a furlough lasted longer than you anticipated when you default they just add that, and you pay an incredible amount of interest,” said Stewart.

401(k) Loan

For more uncertain cash shortages, is it worth it to borrow against a 401(k)?

Stewart said probably not.

“I’d put it in the same category as a payday loan,” said Stewart.

He said the cash a person borrows would cause them to miss any growth in the retirement account.

“You never know when the two best days of the market will be,” said Stewart.

Using Bankrate’s online calculator, if someone borrows $5,000 from their 401(k) at age 30 and takes five years to pay it back, they’ll lose out on $3,200 in growth, assuming a seven percent growth rate in the 401(k). If they never pay it back, the lost growth and tax penalties will cost the consumer $72,000 from their retirement.

Stewart said a smarter option might be an interest-free credit card, as long as a borrower is determined to repay the spending before the zero percent interest rate expired. But he said to make sure to check for hidden fees, such as balance transfer fees, or time limits on the offer.

“I would give a thumbs-up to a zero-percent credit card as long as it was option two or three,” said Stewart.

Line of Credit

His top choice to cover financial emergencies: a line of credit or a home equity loan. Getting either can be difficult if a consumer has limited time or a poor credit history.

Ultimately, Stewart said its best to save for emergencies by creating an emergency fund. The best way to do this, he said, is by asking your company to automatically direct a set amount from each paycheck for savings. Another way is to download a savings app that pulls money from your checking every time you pay a bill or swipe your debit card.

No matter what emergency cash option you pick — you should always pay it back ASAP.