Unaffordable Utah: How Would Utah Fare During A Possible 2020 Recession?

Aug 15, 2019, 11:00 PM | Updated: Aug 16, 2019, 6:02 am

SALT LAKE CITY, Utah – Wall Street bounced back a bit Thursday, finishing up 100 points after dropping 800 points Wednesday. It was the worst day of the year for the market. The drop triggered fears of a possible recession.

The financial collapse and bursting housing bubble a decade ago hit Utah hard. Now, after years of a booming economy, the big question is: When will it come to an end?

Stocks plunged Wednesday, reacting to a “yield curve inversion.” That’s a rare flip when investors can make more on a two-year U.S. Treasury note than the 10-year note. It’s a warning sign that has predicted every recession since the 1950s.

The last time it happened was 2007, right before the Great Recession.

“When you have an inverted yield curve you get a recession on average a year after this,” said Mark Knold, senior economist for the Utah Department of Workforce Service.

UNAFFORDABLE UTAH: Some economists are predicting a 2020 recession due to something happening in the economy called a "Yield Curve Inversion."

It may not happen, but if it does, here are some ideas to recession-proof your personal finances. @laddegan https://t.co/BpVtEdtys7 pic.twitter.com/5r5RwgbjKg

— KSL 5 TV (@KSL5TV) August 16, 2019

That’s not the only caution sign, Knold said. We are also at full employment.

“The merger of those two is around the summer or fall of 2020, so that’s why the recession fears are being talked about now,” he said.

So how would Utah fare in a recession? Knold said Utah has a lot of buffer room to absorb a setback.

“Even when the economy slides, often times, we don’t slide as far,” he said. “The nice thing about the Utah economy – it’s very diverse. Our employment is spread nice and diversely among all the industry sectors. I call that your ‘economic immune system.’”

Pulling out of the last recession, Utah’s booming economy and job growth outpaced the rest of the nation. But while we can have higher highs, we can also experience lower lows.

“Our lows can go one way or another depending on the recession,” Knold said. “The last one, the Great Recession, we actually went a little lower than the national setback.”

For many millennial workers, their only experience with an economic downturn was that lengthy and devastating Great Recession that officially lasted from December 2007 to June 2009.

“Even if we do have a recession it doesn’t necessarily mean that it’s going to be just like the last one,” said Zions Bank economist Joseph Mayans.

Mayans agreed that Utah is well positioned to weather a storm, but said we’re not an island.

“Even though the local economy can be very strong, we could have some side effects of some of those larger companies that are affected by global events,” said Mayans.

While no one can’t predict if a recession is really around the corner, Mayans said it’s still a good wake-up call – especially if you’re in debt, living paycheck to paycheck, or don’t have enough in savings to fall back on.

“It’s a good time to take stock of your household finances,” said Mayans.

Seven Ways To Recession Proof Your Finances

- Start saving money.

- Establish an emergency fund. Experts suggest three months of living expenses, at a minimum.

- Cut expensive memberships and subscriptions.

- Pay down debt. Start with the bills charging the highest interest rate.

- Evaluate your car loan. Can you refinance for smaller monthly payments?

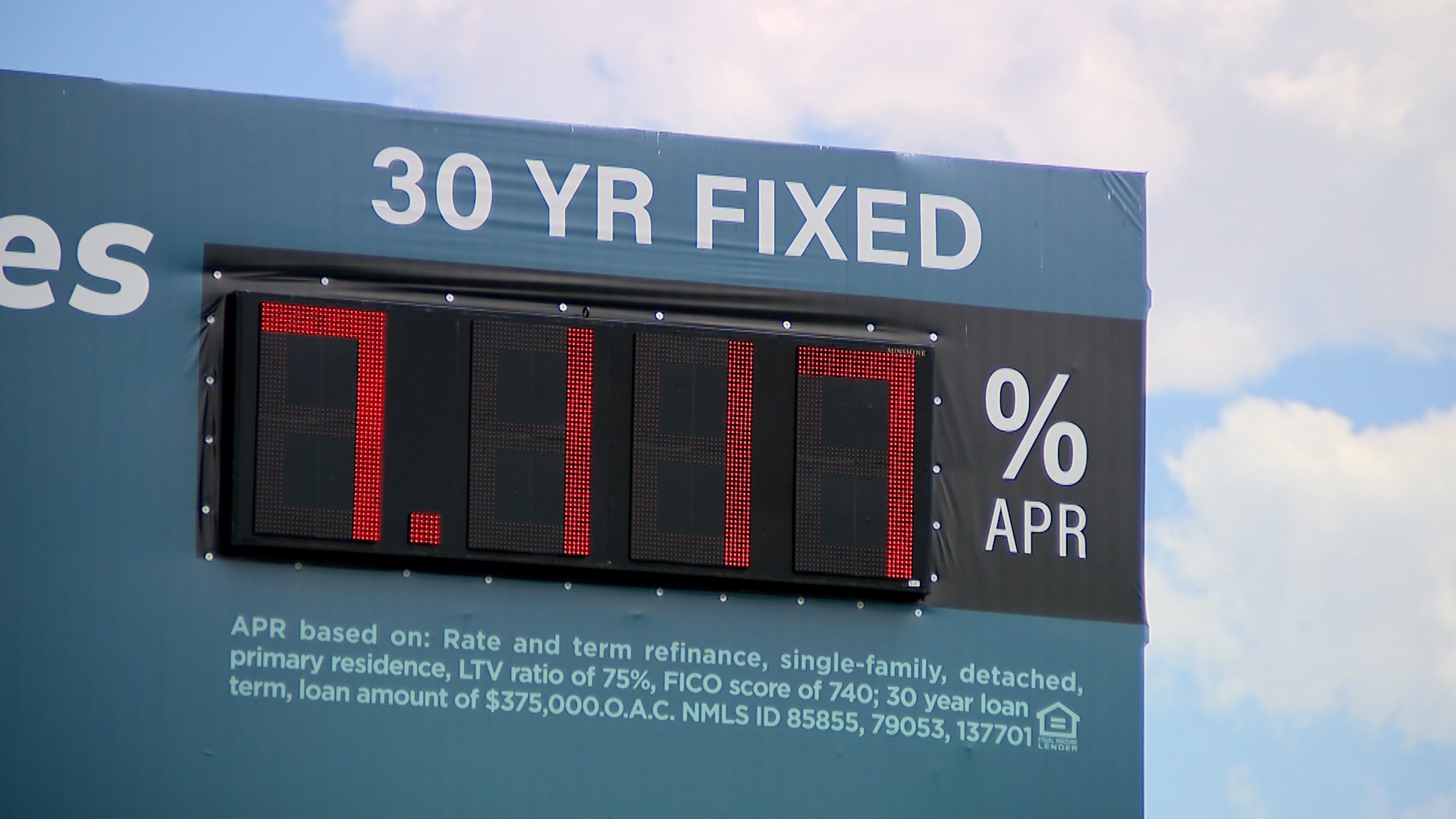

- Examine how much home equity you have and if it could be used provide a cushion or to pay off higher-interest loans.

- Avoid drastic changes when it comes to 401Ks and other investments.

“Don’t try to time these global, international, economic events. Really, the duration of time is your best friend,” said Mayans.

Finally, have a strategy for a job you could pivot to in case your industry faces layoffs.

“Where will my skillsets then go over to that other part of the economy that’s not having problems. That might still be hiring,” said Knold.

For example, there is safety in certain recession-proof jobs.

“Education and healthcare,” said Knold. “They don’t decline during recessions. Not in the state of Utah. We don’t stop educating our children; we don’t stop going to the doctor.”

A word of warning – economists point out that consumers are driving our economy right now, so if everyone were to cut back on spending all at once it could actually help bring on a recession.