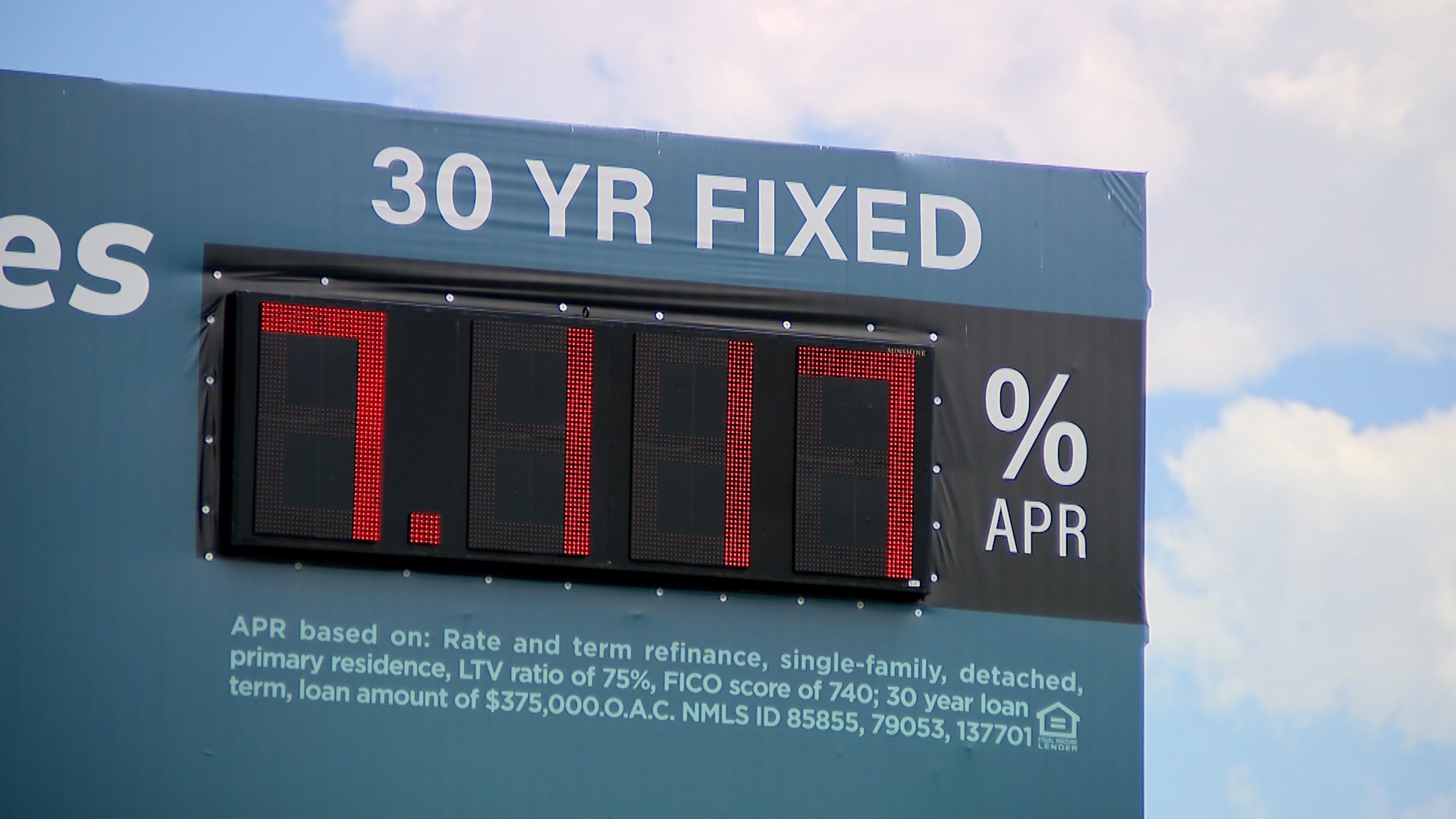

The average long-term US mortgage rate surges to 7.49%, its highest level since December 2000

Oct 5, 2023, 12:53 PM | Updated: Oct 6, 2023, 6:27 pm

Oct 5, 2023, 12:53 PM | Updated: Oct 6, 2023, 6:27 pm

The study conducted by the Utah Foundation reveals that housing affordability and politicians ignoring voters are the top two concerns among Utahns.

2 days ago

It’s one of the most painful parts of inflation right now – rising insurance costs.

7 days ago

Some Utah homebuyers are beginning to give up on owning a home as mortgage rates continue to gatekeep them.

8 days ago

A community in a Moab trailer park is facing eviction, after they waited for six years for an affordable housing project to complete.

10 days ago

In a recent study, Utah was ranked the fifth worst state to find a starter home. Here's why.

20 days ago

A new Zillow study put Utah in the top 15 states with the most "million-dollar cities." But other places in Utah aren't incredibly less expensive, economists say.

29 days ago

Read these tips about internet safety for kids so that your children can use this tool for learning and discovery in positive ways.

Connected printers have vulnerable endpoints that are an easy target for cyber thieves. Protect your business with these tips.

Check out the latest lighting design trends for 2024 and tips on how you can incorporate them into your home.

Experiencing a glitch in your computer can be frustrating, but with these tips you can have your computer repaired without the stress.

Explore the benefits of upgrading to Windows 11 for a smoother, more secure, and feature-packed computing experience.

Get ready for festive celebrations! Discover expert tips to prepare your home for the holidays, creating a warm and welcoming atmosphere for unforgettable moments.