The Federal Reserve rate increase could be a good thing for homebuyers

Jun 15, 2022, 10:36 PM | Updated: 11:20 pm

SALT LAKE CITY – A local mortgage loan officer says the recent rate hike by The Federal Reserve isn’t all bad news.

In fact, Jerry Nielsen, who has helped people get mortgage loans for 20 years, said the .75 hike dropped mortgage rates, at least initially.

It’s all about how investors feel the feds are managing inflation. The most significant single hike since 1994 will raise rates on almost all financing – everything from car loans and credit card rates.

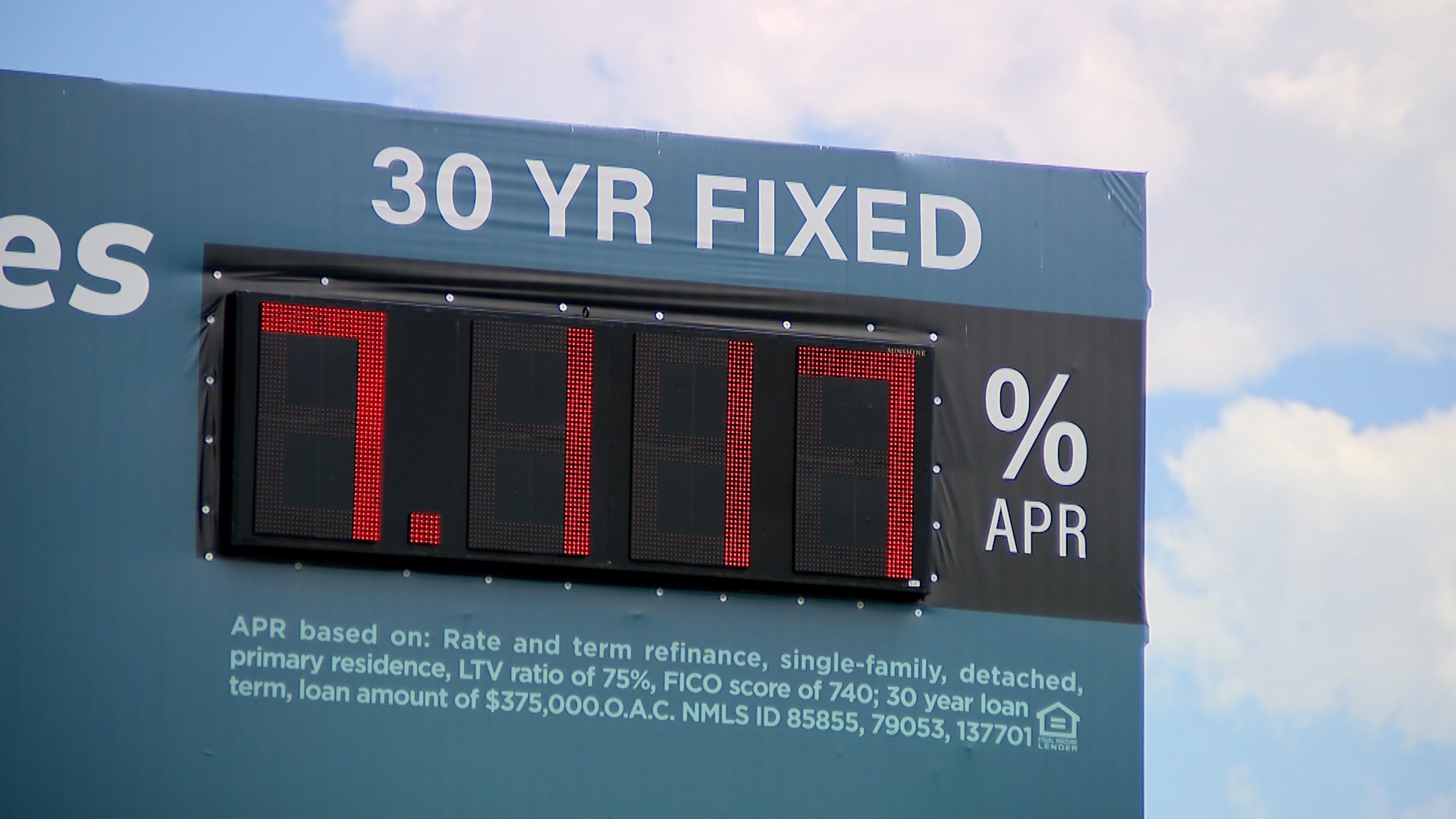

But, at least for mortgages, rates have already been steadily going up over the last six months and really jumped when the Federal Reserve only bumped them by a quarter of a percentage point back in March.

“The market sentiment was they should have increased it by a half a percent,” says Nielsen who explains mortgage rates, that day, jumped immediately based on the impression the feds didn’t have a good handle on out-of-control inflation.

Home prices in Utah have gone up 20% in just the past year.

Combine that with interest rates that are more in line with historic levels, and the housing market, while still strong in Utah, has cooled since it hit a fever pitch last July and August.

That could be a positive thing for people looking to purchase a home.

There is talk of a recession that could hit early next year but, in Utah, there’s still a housing deficit so it’s not probable that prices will plummet.

The change in interest rates, combined with the higher prices, means the market could be shifting from a hot seller’s market, with people coming to the table with “above asking price” cash offers to something that becomes more economically friendly.

Nielsen says now is a better time to buy a house in Utah than it was at this time last year since demand has cooled slightly.

The change means buyers aren’t in stiff competition to purchase homes, often getting into bidding wars.

And, if history is any indicator, houses will continue to appreciate, which means buying now, rather than later, could save you money in the long run.