Fed holds interest rate, markets hit new highs

Mar 20, 2024, 4:13 PM

The Federal Reserve held its key interest rate steady Wednesday for the fifth consecutive meeting. (Chip Somodevilla/Getty Images via CNN Newsource)

(Chip Somodevilla/Getty Images via CNN Newsource)

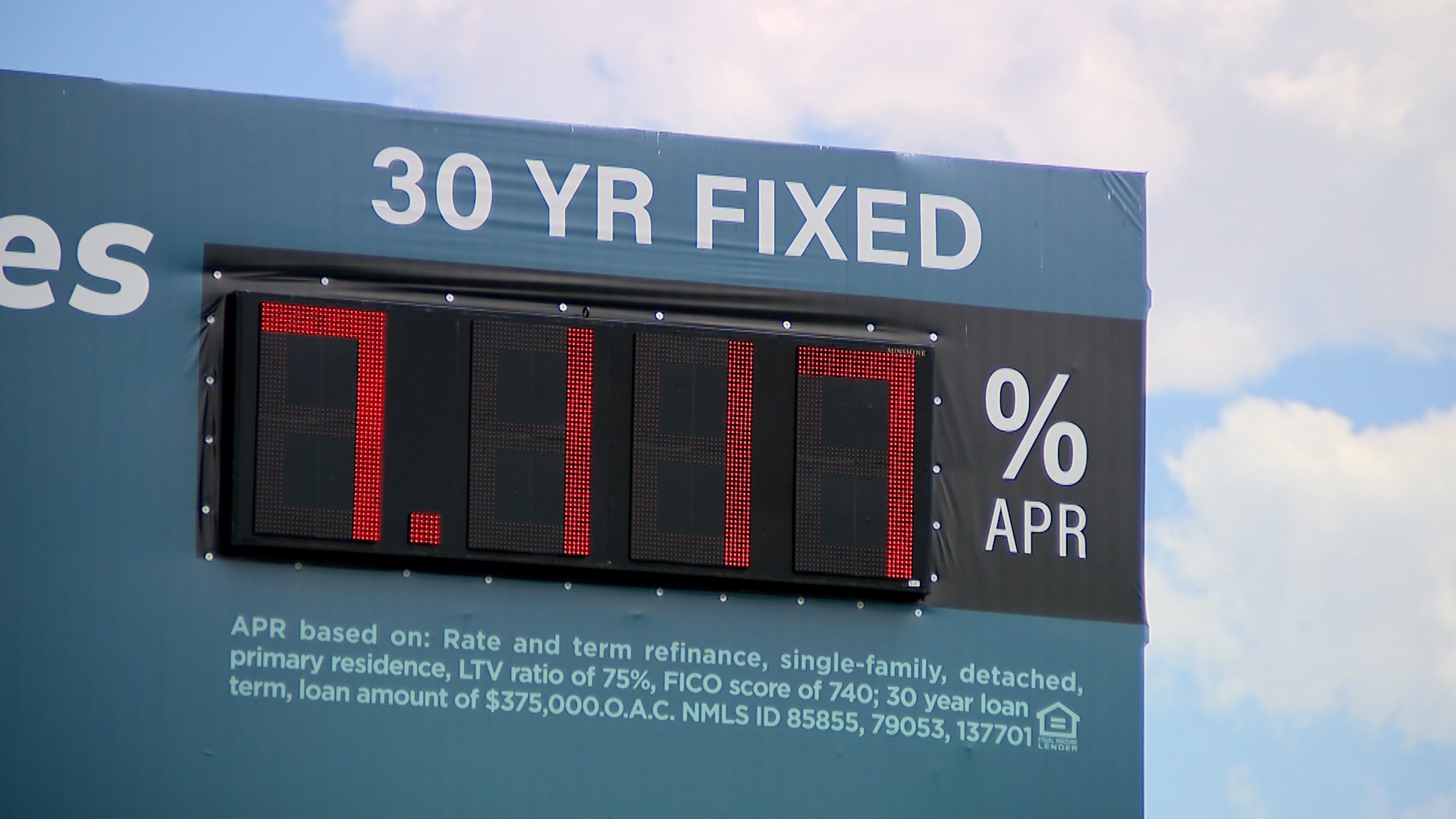

Washington, DC (CNN) —The Federal Reserve held its key interest rate steady Wednesday for the fifth consecutive meeting, as the central bank awaits more data to determine when to cut rates.

The Fed has raised rates aggressively over the past two years in a bid to fight the highest inflation in decades. But while Americans continue to deal with high interest rates and inflation, Fed Chair Jerome Powell said the central bank is still not ready to lower borrowing costs just yet.

Wall Street is betting that the first rate cut will come in the summer.

Fed officials are facing the difficult task of balancing the risk of cutting too soon with the risk of cutting too late — both of which come with consequences. That’s why the timing of that first rate cut is so critical, because it could either undo the progress the Fed has seen, if officials cut too soon, or it could fail to prevent the economy from sharply deteriorating if officials cut too late.

Fed officials also released a fresh set of economic projections Wednesday. They show that central bank officials now expect fewer rate cuts in the coming years than they estimated in December. A majority of Fed policymakers continue to expect three rate cuts this year, but they now see fewer in 2025 and 2026. They expect interest rates in the longer run to be slightly higher than they projected in December.

Economic growth is also expected to be much higher this year than officials estimated.

Officials also reflected in their latest estimates that they expect “core” inflation, a measure that strips out volatile food and energy prices, to be higher this year than previously thought.

US stocks broadly soared to new highs Wednesday, with the S&P 500 topping the 5,200 level for the first time, closing 0.9% higher. The blue-chip Dow also reached a new record, up 401 points, or 1%, at 39,511.34; and the tech-heavy Nasdaq hit 16,369.41, also a new high.

Here are some key takeaways from the Fed’s latest decision.

It’s too soon to know if inflation has stalled

Powell said “We continue to make good progress in bringing inflation down,” but it has become evident there are some persistent price pressures in housing and the services sector.

That could be worrisome for the Fed as it faces the final stretch of its historic inflation fight. Rising shelter costs and a sharp climb in gas prices pushed up consumer prices in February, according to the latest Consumer Price Index.

The Fed chief repeated his usual phrase that inflation’s journey back down to 2% will be a bumpy one.

“We’ve got nine months of 2.5% inflation, now we’ve had two months of kind of bumpy inflation,” Powell said Wednesday in a post-meeting press conference. “Now, there were some bumps and the question is, are they more than bumps? And we can’t know that. That’s why we are approaching this question carefully.”

Economists like to look at data over several months to strip out any “noise,” or month-to-month fluctuations, and make sense of any durable trends. That’s how the Fed is approaching the current situation with inflation; waiting for more data to know if inflation has indeed stalled. Powell added there might have also been some “seasonal effects” that skewed data for January.

Asked about the role of rising shelter costs in pushing up inflation, Powell said there is “some confidence that the lower market rents we’re seeing will show up over time, but there’s a little bit of uncertainty about when that will happen.”

The Fed is in wait-and-see mode

Chair Powell laid out the risks of cutting too soon versus cutting too late, explaining that the Fed is still in wait-and-see mode because there simply isn’t any urgency to cut rates.

“It is consequential,” Powell said. “Fortunately, with the economy growing, with the labor market strong and inflation coming down, we can approach that question carefully and let the data speak on that.”

Powell said officials want to “feel more confident” inflation is headed toward the central bank’s 2% target. Wednesday’s policy statement also made that clear.

“The Committee does not expect it will be appropriate to reduce the target

range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,” it said.

The economy remains on strong footing

America’s economy remains solid by many measures and in Powell’s own view.

“The economy is strong, the labor market is strong and inflation has come way down,” he said.

Economic growth in the first quarter is expected to register at a healthy 2.1% annualized rate, according to the Atlanta Fed’s latest projection, following two straight quarters of growth above a robust 3%.

The job market is still humming along, with employers continuing to add jobs at a brisk pace while unemployment remains low. The jobless rate edged higher in February, to 3.9% from 3.7%, but it has remained below 4% for more than two years.

Jan Hatzius, chief economist at Goldman Sachs, recently told CNN that “it doesn’t look like the economy is anywhere close to a recession.”

If the job market does weaken more than expected in the coming months, that could change the path of monetary policy.

“If you look historically, we’re high. And the longer we stay at that — if inflation continues falling — we’re going to have to start thinking about the employment side of the mandate,” Chicago Fed President Austan Goolsbee told CNBC earlier this month.

It’s also possible that the US economy’s persistent strength could be standing in the way of any further improvement on the inflation front. Officials also consider the role of productivity when assessing growth, which boomed last year.

Consumer spending also remains healthy, but it has cooled down from the red-hot pace in the summer. Spending fell sharply in January, mostly due to the unseasonably cold weather, but the Commerce Department’s latest report on retail spending showed that there was a rebound in February. Broader figures on consumer spending in February are due later this month.

The-CNN-Wire™ & © 2024 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.