KSL Investigates: How To Avoid Inheriting A Timeshare You Don’t Want

Jan 25, 2021, 10:13 PM | Updated: 11:07 pm

MILLCREEK, Utah – Ask just about anyone who has purchased a timeshare and they can tell you, getting rid of it can be a hassle. But imagine being on the hook for a contract you never signed up for yourself.

Many timeshare contracts include a perpetuity clause, which means the contract and all its fees and obligations are yours for life. And it may not end there.

Some timeshare companies are now trying to make people keep paying, even after they are dead.

When it happened to a Millcreek woman, she called the KSL Investigators.

Timeshare For Life

Mac and Vira Bartholomew loved their week or two of family vacations every year: Park City. Lake Tahoe. Oceanside, California. All slices of paradise they bought into when they bought a timeshare.

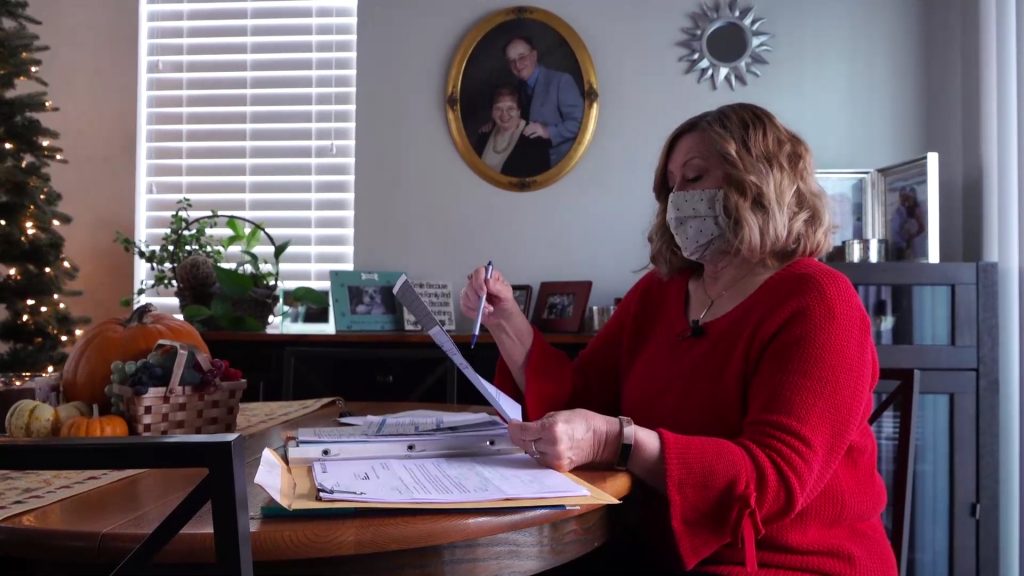

“Breaks my heart a little bit,” said daughter Janeen Bartholomew. “They meant it to be something the family could use for family get-togethers and that was how we were using it.”

Mac and Vira Bartholomew. (Bartholomew family)

Her parents passed away in late 2019, just months apart. But their timeshare has apparently outlived them. The timeshare resort, Club Wyndham, has not stopped demanding money for fees. The thing is: Bartholomew and her siblings want no part of it.

“We didn’t have a discussion before they passed as to what do we want to see happen to this. Is that going to pass away with mom and dad? Can we sell it? Do we get the money back that they put into it?” Bartholomew asked.

Billing The Estate

She said the bills from Club Wyndham totaled about $500, every month.

“I was trying to be honest and keep the account current and everything,” she explained. “I put my credit card information into the autopay.”

Janeen Bartholomew and her siblings inherited their parents’ timeshare. (KSL-TV)

After three months of keeping up, the family had enough. They wanted out of a timeshare contract they inherited against their will. Bartholomew said when they could not get answers from Club Wyndham on getting out, they stopped paying.

“Are they going to be hounding me? Is that going to show up on my credit card, or is it going to show up on my credit?” she said.

Her concerns are real. A collections notice showed up in November demanding her parents’ estate pay up, quickly turning their timeshare into an expensive burden.

“It’s a lovely thought to get your family together, but at what cost?” asked Bartholomew.

And timeshares can get costly. The American Resort Development Association reports the typical timeshare costs $23,942, and tack on an additional $1,000 per year for maintenance fees. ARDA officials estimated the industry was grown to $10.5 billion.

But is Bartholomew and her siblings truly, legally on the hook for their mom and dad’s decision to buy a timeshare?

Estate Law And Timeshares

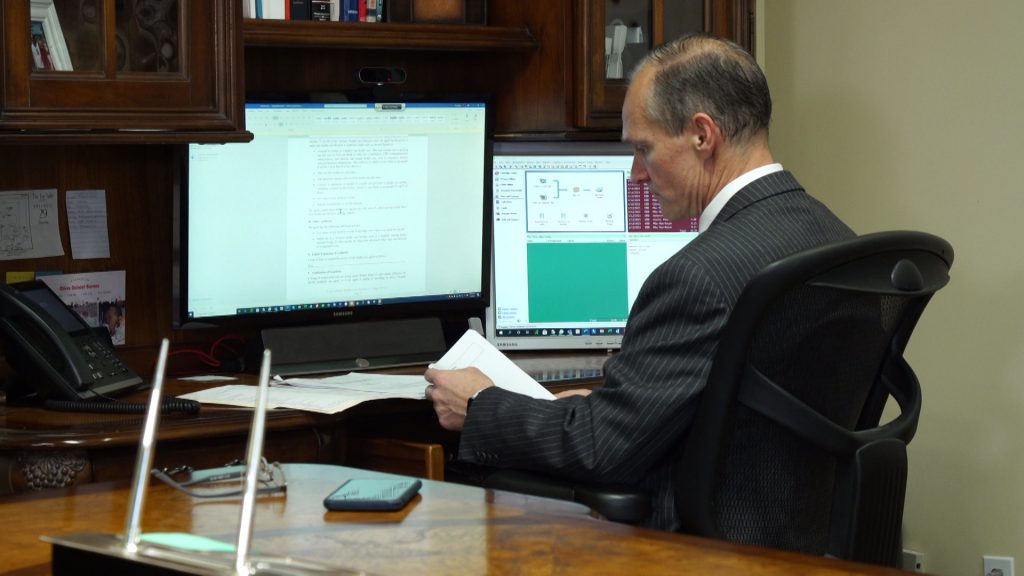

To find out, the KSL Investigators took it to Eric Barnes of the ElderCare Law Firm. He’s one of a handful of Utah attorneys who specializes in elder law and he fields a lot of questions about timeshares.

Eric Barnes of the ElderCare Law Firm. (KSL-TV)

“A lot of times the parents think they’ve got something really special to pass onto the kids and the kids may not see it that way,” said Barnes.

He explained that if you die owning a timeshare, that timeshare becomes part of your estate. Its obligations are passed onto your next-of-kin or your estate’s beneficiary.

But they do not have to accept it.

“Nobody is obligated to take any inheritance,” Barnes said. “We all have that right to refuse it.”

Whether you inherit a crumbling house, a jalopy of a car, a pet alligator or a timeshare – you are not obligated to accept anything someone leaves you.

“You can disclaim any inheritance, that is a way of avoiding having it come to you,” said Barnes.

Still, walking away does take work. You must file a disclaimer of interest with the probate court saying you reject the timeshare. And you only have nine months after the death of your loved one to file it.

Another thing to keep in mind: when the next-of-kin rejects the timeshare, it goes to the next heir, then the next and the next – so each family member needs to file their own disclaimer.

Caveats To Disclaimers

Barnes said if the timeshare is disclaimed by all heirs, the resort will likely foreclose and any leftover debt for fees would have to be paid through estate assets.

“Somebody is going to have to deal with it at some point,” he explained.

If you’re planning to refuse a timeshare, don’t use it — period. Don’t try it out for a weekend, don’t let a buddy use it or take one last trip to say goodbye to mom and dad.

“If you want to disclaim you can’t receive any benefit of that thing that you are disclaiming,” said Barnes. “Once you receive a benefit – you’ve lost that opportunity.”

He recommended timeshare owners talk with their adult heirs.

“And to do it with time so that they can – if they don’t want that – then they can start the process of getting rid of it.”

The KSL Investigators reached out to Club Wyndham on Janeen Bartholomew’s behalf. They told us: “Our team is continuing to investigate the issue and are trying to understand the chain of ownership and any inquiries that were made by the family so we can respond appropriately with a suggestion.”

Meanwhile, Bartholomew was considering walking away from her mom and dad’s timeshare. In the end, it won’t hurt her personal credit, but the resort could file a claim against her parents’ estate.

“I think it would break mom’s heart to know that it came down to this,” said Bartholomew. “But we’ve made that decision.”

Timeshare Reselling Scams

Barnes said in some cases, people who have inherited unwanted timeshares have sold them for far less than what was paid. Sometimes, they’re just given away.

“There are people that will pick those up if they don’t have to pay anything for it,” he explained.

If you choose to offload an unwanted timeshare by selling, be very careful. That is a market rife with scammers promising quick sales while charging thousands of dollars upfront.

“We’ve seen people spend thousands and thousands of dollars and with promises that they were going to be able to sell their timeshare,” said Barnes. “All they got was nothing – they didn’t even get the timeshare sold.”

ARDA, the American Resort Development Association, maintains its list of timeshare brokers it finds reliable here: https://www.arda.org/advertising-and-resale-providers-directory.