Gephardt: Surviving The COVID-19 Credit Crunch

Jun 18, 2020, 10:10 PM | Updated: Jun 28, 2020, 3:36 pm

SALT LAKE CITY, Utah – Imagine having your credit card shut off without any warning.

It is a scenario playing out in Utah and across the country, leaving a staggering number of people without what could be a lifeline in this rough economy.

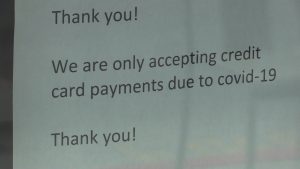

As more and more people are choosing plastic as their payment option of choice, many retailers are leaving cash behind – and it’s not just due to the risk of COVID-19.

Last year, Vivint Smart Home Arena put an end to cash transactions. At the time, the argument was that credit, debit and mobile payments kept the lines moving faster. With the pandemic, other businesses are falling in line.

From restaurants to hardware stores, you’ve likely seen the signs: no cash allowed.

The KSL Investigators found that’s led to an embarrassing scenario for thousands all over the country.

As the economy worsened, some credit card companies lowered credit limits and closed accounts, sometimes without any notice.

Imagine it: Getting to the end of your meal, or to the front of the line at the checkout and your card gets declined – over and over again. You call the issuer to ask if there is some sort of problem, maybe even fraudulent activity, but you are told you are no longer creditworthy in the eye of the issuer.

How can that be? You have been good with your credit in the past – making regular payments and on time without a problem for years. Then, out of the blue, you find out you cannot use your card anymore.

On the bright side, you’re in good company!

Nearly 50 million Americans said they’ve had the credit limit slashed on at least one of their credit cards involuntarily, or even had a card closed by their issuer in the past 30 days, according to a new report from CompareCards. That adds up to one in four credit cardholders in America.

By law, a credit card company must contact you if they change the terms, like bumping up your interest rate. But here’s the thing – if they decide to cut your limit or to cut you off entirely, they do not have to tell you.

“It’s really troubling,” said Matt Schulz, chief credit analyst with LendingTree.

He said it is part of life in a recession.

“We saw it happen a decade ago with the Great Recession,” Schulz explained. “Banks get really nervous and really risk-averse when unemployment spikes and when the economy takes a really sharp turn really quickly.”

Having your card abruptly shut off can not only cause embarrassment at a restaurant or store, but it can also be an expensive problem for you, too. A slashed credit limit can wreak havoc on your credit score.

That will leave you paying more on interest the next time you finance anything, whether it be a house, car, furnace – you name it. It can also put people in a desperate situation for things they need right now, like food.

“An awful lot of folks are going to be without a lifeline that a lot of folks were depending on,” said Schulz.

When plastic is the only option at stores, but credit is no longer an option, folks may hope to lean on their debit cards. But chief financial analyst Greg McBride of Bankrate.com said that is easier said than done. “We were in a pretty tenuous spot from a saving standpoint, to begin with,” said McBride. “Weak savings is kind of up there with baseball and apple pie at this point as American institutions. Back in January, which seems like light years ago, even then, only 41% of households could cover an unplanned $1,000 expense out of savings.”

The problem, of course, has grown worse since January. A Bankrate.com survey found 31 million Americans already have or plan to tap into their retirement funds as an immediate source of income because of the coronavirus pandemic.

Others are turning to ridiculously high-interest lenders.

“On credit cards, the average (interest) rate is over 16% and if you have to resort to things like payday loans, where you really get into trouble is rolling that over from one period to the next,” said McBride. “That’s where you could end up paying back many more times the amount you actually borrow.”

McBride’s advice: If you are in a position to squirrel away money, do it and do it now.

And Schulz said if you have a credit card gathering dust in your wallet, it may be worth the hassle of using it for small purchases like gassing up your car from time to time, or for the occasional snack run. That can be enough for your credit card company to keep your account open when you need it the most.

“The most important thing for folks to know is that the cards that are most likely to be closed or have their limits reduced are the ones that aren’t used very often, simply because banks aren’t making any money off of them,” said Schulz.