KSL Investigates: Emails To Lawmakers Show Utahns’ Concern For Tax Reform

Jan 23, 2020, 5:56 PM | Updated: Jun 16, 2022, 11:49 pm

FILE - The Utah State Capitol in Salt Lake City (Silas Walker/Deseret News)

(Silas Walker/Deseret News)

SALT LAKE CITY, Utah — After a successful effort to repeal a tax reform bill showed many Utahns weren’t happy with the reform, the KSL Investigators dug through hundreds of emails sent to Utah lawmakers over the past year to find out how the public viewed the proposals and whose voices were heard.

Through a public records request, the KSL Investigators obtained 1,361 emails.

They showed a clear message from constituents and small business owners: we don’t like the proposed tax changes. Some emails from businesses included suggestions that ended up in the final bill.

2019 Tax Restructuring And Equalization Task Force

The Tax Restructuring and Equalization Task Force was created at the end of the 2019 General Session of the Utah Legislature. It was introduced after HB441, another tax reform proposal, failed to move forward following outcry.

It appointed five members of the Senate and five members of the House:

- Sen. Lyle Hillyard (R) — co-chair

- Sen. Karen Mayne (D)

- Sen. Kirk Cullimore (R)

- Sen. Lincoln Fillmore (R)

- Sen. Curtis Bramble (R)

- Rep. Francis Gibson (R) — co-chair

- Rep. Joel Briscoe (D)

- Rep. Tim Quinn (R)

- Rep. Mike Schultz (R)

- Rep. Robert Spendlove (R)

This committee was tasked with leading efforts in soliciting public feedback, studying tax systems to make recommendations to address structural imbalances among revenue sources, and report findings.

Following multiple town hall meetings, committee meetings, and constituent input, the final product was SB2001. Task Force members proposed an income tax decrease, while increasing tax on grocery items, expanding sales taxes on certain services and goods, and increasing fuel tax.

Public Comments After SB441

In Dec. 2019, following the passage of SB2001, KSL Investigators requested emails relating to the tax reform bill to get a feel for the comments given to lawmakers.

We received two data sets, the first being emails involving the five senators on the Task Force between Feb. 28 – July 3, 2019. This time frame covers when HB441 was introduced and through the first few months of the creation of the Task Force.

This collection included 437 emails from constituents, large businesses, interest groups, small businesses and other politicians.

Five state senators were named to the Task Force.

Most comments during this time focused on the failed HB441 tax bill. Some trends in the comments included: feeling the bill was rushed; there wasn’t enough transparency; they wanted the legislature to look at cuts in spending first before restructuring taxes; they felt the current tax structure and state budget didn’t support a need for change.

Protecting education funding was also a huge concern, as 30% of Utah income tax funds K-12 education.

These are some comments we saw from constituents:

- “Sales tax is the most regressive form of taxation available to the government. This is basically a tax cut for the wealthy. Take the sales tax off food. Give the middle class and below a break.”

- “The comprehensive nature, the realized and unrealized impacts to our citizenry coupled with the speed, lack of transparency, and lack of public input causes me great concern.”

- “It does not provide tax equalization, nor does it reduce taxes as claimed. All it is does is shift the tax burden and provides a framework for future tax increases that could cripple our state economy by driving businesses away.”

- “[HB411] will have a disproportionate effect on those with higher needs, like the working poor in our communities.”

- “Focus on individual taxpayers rather than on guaranteeing government an ever-increasing amount of revenue. Ask what the impact will be on the retiree trying to get by on a small pension supplemented by Social Security, on a single mom with two children with an income of 138% of the poverty level, on young couples just trying to pay their rent or mortgages, on a small business owner trying to keep her business afloat, etc.”

Emails To House Task Force Members Show Ideas, Concerns

KSL Investigators also reviewed 924 emails for the five House representatives serving on the Task Force. They range in date from May 14 – Dec. 30, 2019.

Five state representatives were also named to the Task Force.

The trend shows very few constituent emails from citizens at the start of this time frame. Most emails from May to September are from businesses, telling of their support, concerns, and suggestions for the Task Force.

Some suggestions included in the emails that ultimately manifested in SB2001 include:

- An email in July from the St. George Chamber of Commerce suggesting “the full sales tax could be placed back on food and a grocery tax credit could be given for low-income taxpayers to offset that burden.”

- An email from an attorney at Durham Jones & Pinegar suggests modifying sales tax to include services like “Uber/Lyft, Airbnb…streaming videos, and some other ‘shared services,’” but discourages sales taxes on things like “music lessons, lawn mowing services, etc.”

- An email with an accompanying spreadsheet from Zions Bankcorporation suggested an “increase state sales tax rate on food from 1.75% to 4.85%” which lists the advantages as “if you eat, you pay more sales tax. If after eating you stay alive, you pay less income tax.”

Comments from the general public started ramping up in the fall when the Task Force unveiled proposals on taxing services like pet grooming, veterinary services and salon services. Dozens of people and small businesses wrote to lawmakers, almost all of them voicing opposition to these proposed service taxes.

“A Tax Increase On Food And Gas Is Completely Absurd”

The topic which generated the most emails to these representatives was the proposed grocery tax increase. Hundreds wrote in with the vast majority asking that this tax not be increased.

Some comments about the food tax included:

- “I already have to work a ton of overtime just to make ends meet, I’m afraid that if you pass this tax reform I may have to pick up a second job in order to afford food and gas for my family!!”

- “A credit at the end of the year doesn’t make up for having to find extra money each week for food.”

- “I do not support increasing the food tax. This is an extremely regressive tax that negatively affects the neediest households.”

- “The reality is, when you’re struggling to survive a tax credit doesn’t help put food on the table or pay the bills.”

- “We need to work to close the gap between the haves and have-nots, not keep increasing that gap.”

- “For once, take a realistic look around you. Not everyone in Utah can afford an increase in Utah’s food tax. Someone will struggle with this. Someone will have to go without something, to make up for the loss of more of their food budget.”

- “I think that the tax on food should be eliminated. People need lower daily living costs, not hypothetical tax credits once a year that would be irrelevant for people who don’t file taxes or have resources to apply.”

Despite several emails urging caution and asking lawmakers to take time to develop the tax plan after continuing to listen to public input, the 2019 Second Special Session was scheduled, 15 days before Christmas. SB2001 passed on Dec. 12 and was signed by the governor the following week.

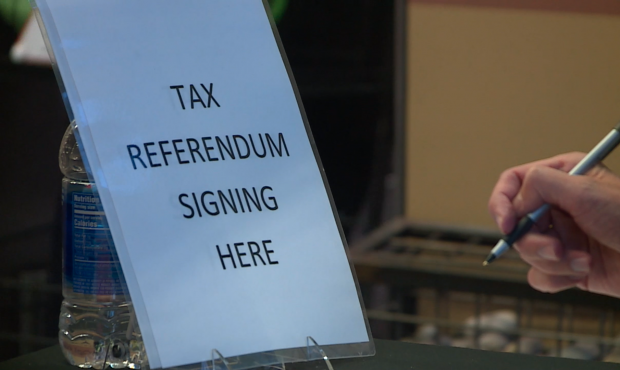

The governor, Senate president, and speaker of the House all announced today that SB2001 would be repealed in the 2020 General Session following the success of a referendum that would put the law on the November ballow.

Have you experienced something you think just isn’t right? The KSL Investigators want to help. Submit your tip at investigates@ksl.com or 385-707-6153 so we can get working for you.

KSL Investigators Previous Coverage:

KSL Investigates: How Much Will Utahns Save in Tax Reform Proposal?