What you should know about extended car warranties and how to fight denials

May 2, 2024, 10:13 PM | Updated: 10:25 pm

SALT LAKE CITY — One after another, the KSL Investigators heard from Utahns who paid monthly for an extended auto warranty but have not had a smooth ride in their repairs covered.

“I feel like I shouldn’t have got the warranty … if it’s not going to do me any good,” car owner Bona Rosa told KSL after her warranty provider refused to pay out for a broken transmission.

Their experiences have raised a red flag over at the State of Utah’s Insurance Department.

“We just want to always make sure that consumers get what they’ve paid for,” said Jon Pike, the department’s commissioner.

Pike said it’s not okay for extended auto warranty providers to reject claims out-of-hand without inspecting vehicles and ignoring information from certified mechanics.

He believes it is not okay for extended auto warranty providers to reject claims out-of-hand without inspecting vehicles and ignoring information from certified mechanics.

“I think that’s where we and, if necessary, Consumer Protection (Utah Division of Consumer Protection) could come into play,” Pike said. “And say to the company, ‘Are you living up to your end of the contract?’”

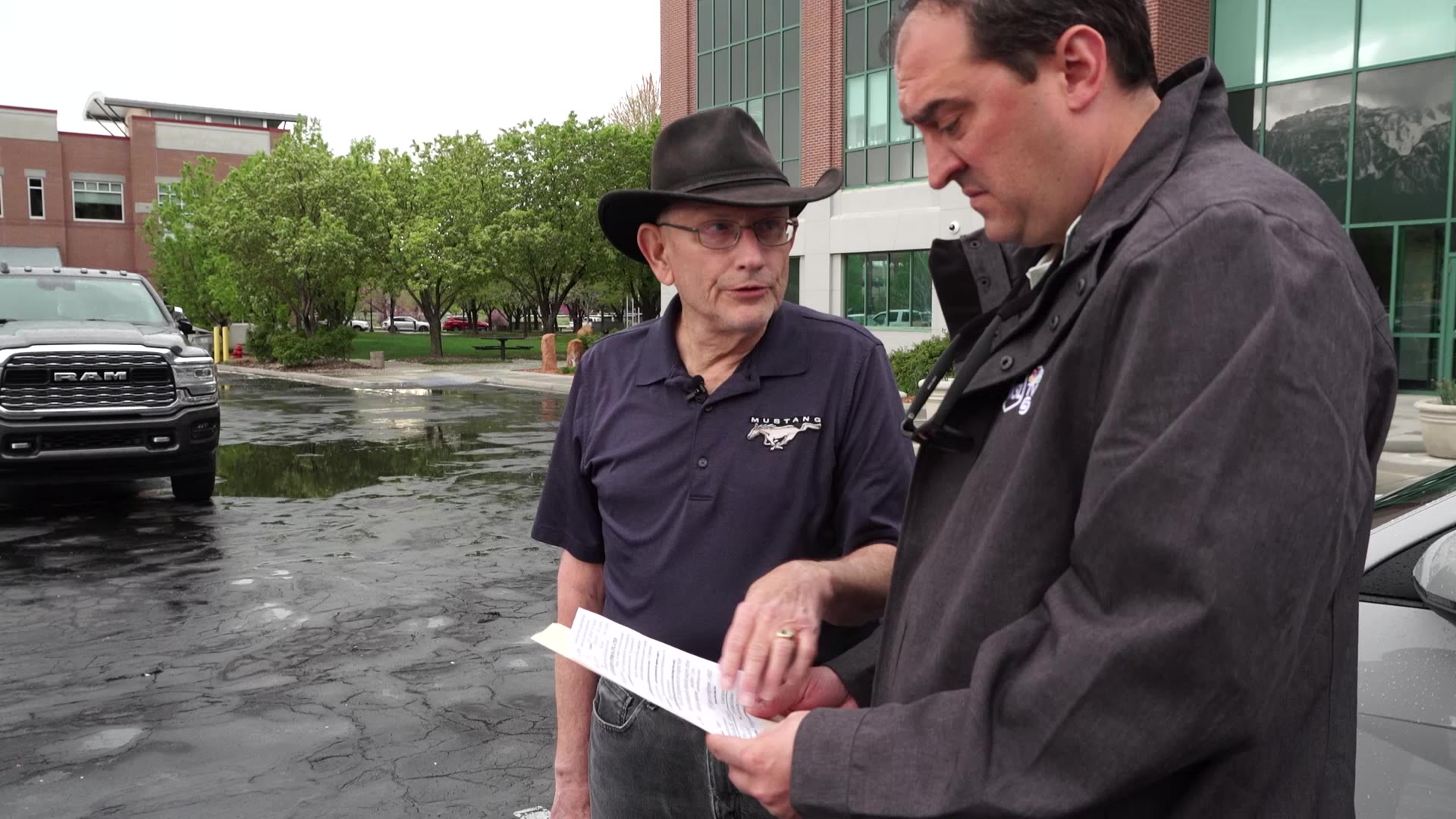

Matt Gephardt talking to the State of Utah’s Insurance Department’s commissioner, Jon Pike. (KSL TV)

And Pike said anyone considering buying an extended car warranty has to actually review a contract’s specific terms. They’re packed with loopholes.

“(You) want to make sure that you look at what your contract that you’re signing says,” he said. “So, you know, what your coverage is. What your limitations are.”

Pike said to be sure you know what’s required of you – like proof you followed all the automaker’s guidelines on maintenance to the tee. And if you’re want coverage on a used car, know your claim can be shot down because of issues with the car before you bought it.

“It definitely helps to know as much as you can about the history of the car,” he said.

Get Gephardt helps Lehi man to get help from electric carmaker’s warranty after battery fails

And if you’re sure your claim should be approved, but the provider still sticks its guns, file a complaint with the Insurance Department and the Division of Consumer Protection.

“Between the two of us, hopefully we can get them to change their tune,” Pike said.

An extended auto warranty provider caught breaking Utah’s service contract law can be fined double the profit they made from the incident, plus $1,000. The commissioner can also ban a repeat or serious offender from doing business in the state.