Can your insurance company drop you like a rock for too many replacement windshield claims?

Sep 25, 2023, 10:39 PM

SALT LAKE CITY – Daniel Wheelwright is the driving definition of road warrior. His job keeps him on the road pretty much all the time.

“I drive a lot for work, about 50,000 miles a year,” he said. “And because I drive so much during the day, there’s all kinds of trucks doing construction, loading and hauling stuff.”

Racking up that sort of mileage on Utah roads in those sorts of conditions has steered Wheelwright’s Tesla straight into “rock chip city.”

“One of them spread halfway across the windshield and it just spread overnight,” he said.

Wheelwright told KSL’s Matt Gephardt that he drives around 50,000 miles every year. (Mark Wetzel, KSL TV)

One claim too many

Wheelwright says he has had three such chips grow into big-time cracks. He says when the windshields could not be repaired, they had to be replaced: three of them in two years. That third claim, apparently damaged his relationship with his insurer.

“Then the insurance company sent me a letter saying, ‘we’re dropping your comprehensive and you’ll have to figure it out,’” Wheelright said.

Daniel Wheelwright says his insurance company cancelled his coverage after he made three claims for new windshields in two years. (Mark Wetzel, KSL TV)

The reason given by the insurance company? Too many comprehensive coverage claims. Wheelwright says paying out-of-pocket for a new windshield on his Tesla will cost him around $1,200.

“Tesla’s the only one that makes the glass, so you have to get it through them,” he explained. “And they have to do all kinds of recalibrations and junk.”

Driving with broken glass

Driving around with a badly cracked windshield is not an option for Wheelwright wants to consider.

“I’ve heard some of the structural stability of your car comes from the windshield,” he said.

The National Highway Traffic Safety Administration has found windshields do support a car’s roof in a rollover. In many cars, airbags exert force on a windshield when they deploy, meaning a large crack could compromise their effectiveness. Plus, driving around Utah with a cracked windshield can win you a ticket from law enforcement.

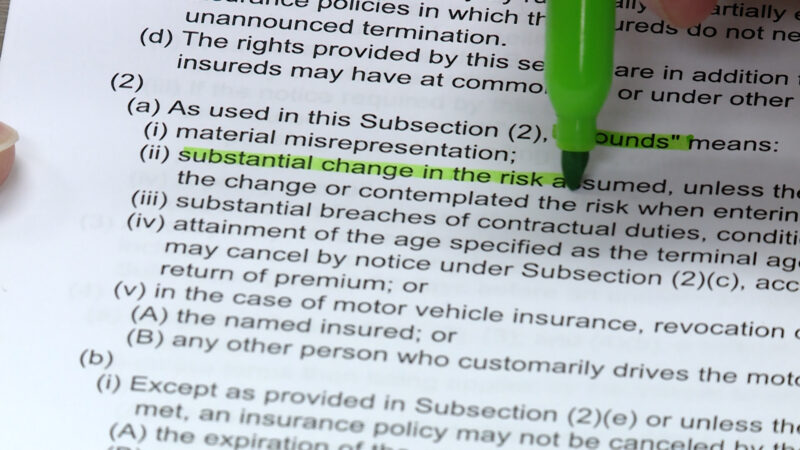

So, can Wheelwright really get dropped for too many glass claims? The KSL Investigators combed through Utah law and found indeed, an insurer can drop you for too many comprehensive claims, which include windshields. But an insurance company can’t jack up your premium because of any claim where you are not at fault. That goes whether you’re getting a new policy or renewing.

The KSL Investigators found Utah law says insurers have grounds to drop coverage for too many comprehensive claims, such as windshield replacements, if there’s a substantial change in the risk. (Jeff Dahdah, KSL TV)

Where does all this leave Wheelwright?

The KSL Investigators reached out to Wheelwright’s insurer, State Farm, to ask how often is too often for glass claims and about his concern about having an intact windshield. The company didn’t answer those questions citing privacy. But in an email, a spokesman wrote they have a responsibility to “make good decisions” to “keep rates affordable,” adding, “Sometimes that means that we have to make the tough decision to no longer insure a vehicle.”

“That just leaves me in a pickle,” Wheelwright said. “I’m just forced to leave them.”

Not just Tesla drivers

Many drivers besides Tesla owners can expect to pay over a $1,000 to replace windshields because of their advanced tech: sensors and lenses for lane assist, adaptive cruise control, emergency braking and so on. Some insurers sell full glass coverage policies as add-ons. Those can help you avoid a deductible. But generally, if your deductible costs more than it will to replace a windshield on your own, leave your insurance out of it.