Unaffordable Utah

KSL TV

Sunday Edition: Megan McArdle and Moe Egan

This week on Sunday Edition, Boyd Matheson is joined by Washington Post columnist and author Megan McArdle as they examine the obstacles people across the nation are facing to building better lives. Then, the Director of Neighbor Recruitment for The Other Side Village Moe Egan talks about how the village is preparing for its first villagers. And, Boyd shares his thoughts on what makes a village- a place where we all exist- the most valuable.9 months ago

Ladd Egan

45 Utahns buy homes in initial week of $20k assistance program

More than $3 million has already been spoken for during the first week of Utah’s new, $20,000 first-time homebuyer assistance program.9 months ago

Bridger Beal-Cvetko, KSL.com and Ladd Egan, KSL TV

Utah releases online tool to make home valuations more transparent

As home prices have risen in recent years, many homeowners have found themselves paying more in property taxes even if their mortgage rate remains the same.9 months ago

Matt Gephardt

Rent prices dropping nationwide but Wasatch Front renters face different picture

While rent has been slowly decreasing in Utah, compared to other parts of the country, it's still falling behind.10 months ago

Andrew Adams

Lender: New Utah First-Time Homebuyers Assistance Program doesn’t go far enough

A new Utah program designed to give first-time homebuyers a break on their new house purchases is receiving criticism for how practical it is.10 months ago

By Anna Bahney, CNN

US mortgage rates climb to highest level since November

US mortgage rates jumped higher last week as uncertainty about the debt ceiling standoff sent bond yields rising.11 months ago

KSL TV

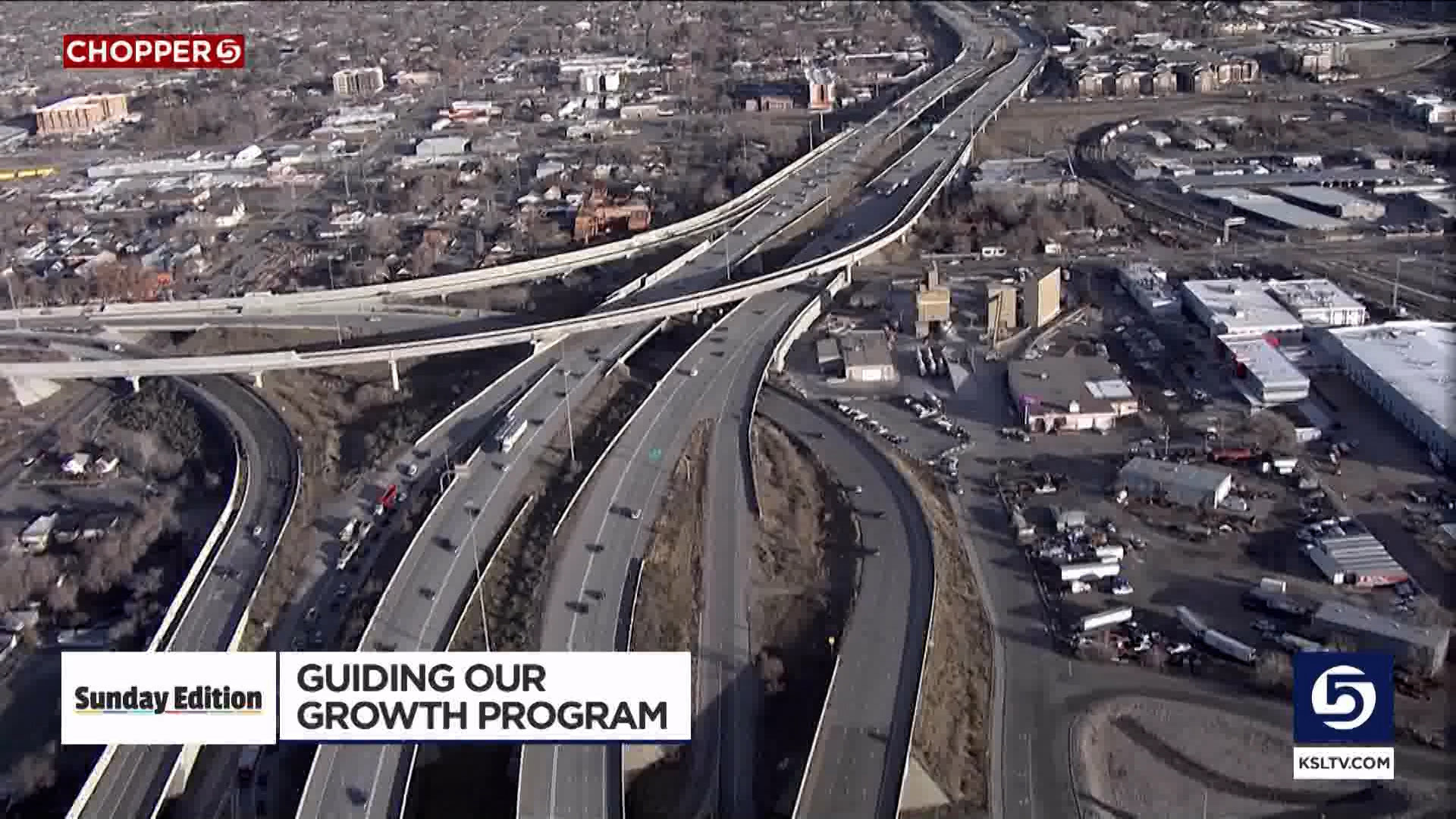

Sunday Edition: Democratic Presidential Election, Utah All-Day Kindergarten, Guiding Our Growth Program

This week on Sunday Edition, Doug talks with former state senator Scott Howell about the Democratic Nomination for the Presidential Election, Christine Elegante from the Utah State School Board about the all-day kindergarten program, and Envision Utah's Ari Bruening about the Guiding Our Growth Program.12 months ago

Ladd Egan

Utah’s $20k first-time homebuyer assistance program starts in July

Utah’s new $20,000 first-time homebuyer assistance program created by the legislature earlier this year is set to rollout in the beginning of July.1 year ago

Ladd Egan

Unaffordable Utah: Start a side gig to bring in extra cash

Looking for a way to stretch your family’s budget and battle inflation? A side gig could bring in extra income to make ends meet, pay off debt or make a large purchase.1 year ago

Anna Bahney, CNN and Ladd Egan, KSL TV

Mortgage rates climb to the highest level in a month

Mortgage rates rose this week, after five weeks of falling.1 year ago

Matt Gephardt & Sloan Schrage

Utah’s red-hot housing market is calming down, so is now a good time to buy a house?

It may not be the buying frenzy we saw a couple of years ago, but licensed realtor Jennifer Gilchrist said the Wasatch Front's housing market is still plenty robust, partly because we are now in the spring home-buying season.1 year ago

Ladd Egan

Utah bill seeks to help first-time homebuyers

A bill making its way through the Utah Legislature would create a first-time homebuyer assistance program.1 year ago

Britt Johnson, KSLNewsRadio

Utah ranks 45th in the country for affordable housing

It’s no surprise that housing is expensive right now, but it’s that way everywhere, right? Wrong.1 year ago

Ladd Egan

Unaffordable Utah: Shift your budget to combat inflation

After battling high inflation for nearly two years and a rollercoaster of gas prices, experts say it’s time for Utahns to make some budget shifts to survive the persistent higher prices.1 year ago

Tamara Vaifanua

Tips to reduce your utility bills this winter

A lot of Utahns are shelling out more to keep their homes warm this winter -- about 17% more due to inflation.1 year ago

Matt Gephardt

Gephardt Busts Inflation: Rent prices down nationwide but very high in Utah

All over the country, the cost of rent is finally starting to go down. But that is not the case here in Utah.1 year ago

Ladd Egan

Unaffordable Utah: Keep the holiday magic alive without breaking the bank

From the Thanksgiving turkey to the presents under the tree, the holidays are expected to be more expensive this year.1 year ago

Ladd Egan

Unaffordable Utah: Mortgage rates climb again as buyers look for price reductions

Utah's housing market is whiplashing as last year's buying frenzy seems to have slowed down to signs of a recession.2 years ago

Jed Boal, KSL TV

Work begins on 300 affordable housing units for Salt Lake seniors

Salt Lake County made a big move Friday to preserve and improve nearly 300 affordable housing units for seniors.2 years ago

Ladd Egan

Home valuations jump dramatically, but watchdog group expects modest increase in property taxes

Assessors across Utah are finishing up home valuations for upcoming property tax notices, and two counties are already reporting big increases in values.2 years ago

Ladd Egan, KSL TV

Utah housing expert predicts pullback in activity because of mortgage rates

An expert in Utah’s housing market expects that rising mortgage rates will cause a pullback in real estate activity and a slowdown in home price increases.2 years ago

Lauren Steinbrecher

SLC neighborhood townhall questions Affordable Housing Incentives

Thursday night, concerns arose at a community townhall in a Salt Lake City neighborhood over an affordable housing incentives proposal, that some worry is deeply flawed.2 years ago

Ladd Egan, KSL TV

Unaffordable Utah: Budget-friendly family summer fun

After two summers of pandemic restrictions, Utah families are itching to have some fun. If inflation, gas prices, and sky-high plane tickets are taxing your budget, don't worry! KSL has the solutions.2 years ago